Money Reset Checklist for Men Over 40: Simple Steps to Fix Your Finances

Here’s the Thing: You’re Not Behind on Money. Most men in their 40s and 50s feel like they’re behind financially. You’re not alone. Maybe you didn’t start investing early enough. Maybe you made some money mistakes. Maybe life just got in the way.

Here’s the real talk: it’s not too late to reset. In fact, starting now—even with small steps—puts you ahead of most people who keep waiting for the “perfect time.”

“The best time to plant a tree was 20 years ago. The second best time is now.”

– Chinese Proverb

This financial reset checklist is designed for you. Whether you make $40,000 or $400,000 a year, these steps work. No fancy jargon. No complicated systems. Just practical moves you can start this week.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

What Is a Financial Reset (And Why You Need One)?

A financial reset simply means taking a hard look at your money situation and making intentional changes. Think of it like a fitness reset—you wouldn’t expect to run a marathon without training first, right? Your finances need the same approach.

A reset isn’t about being perfect. It’s about being aware and making small, consistent adjustments. That’s how real change happens.

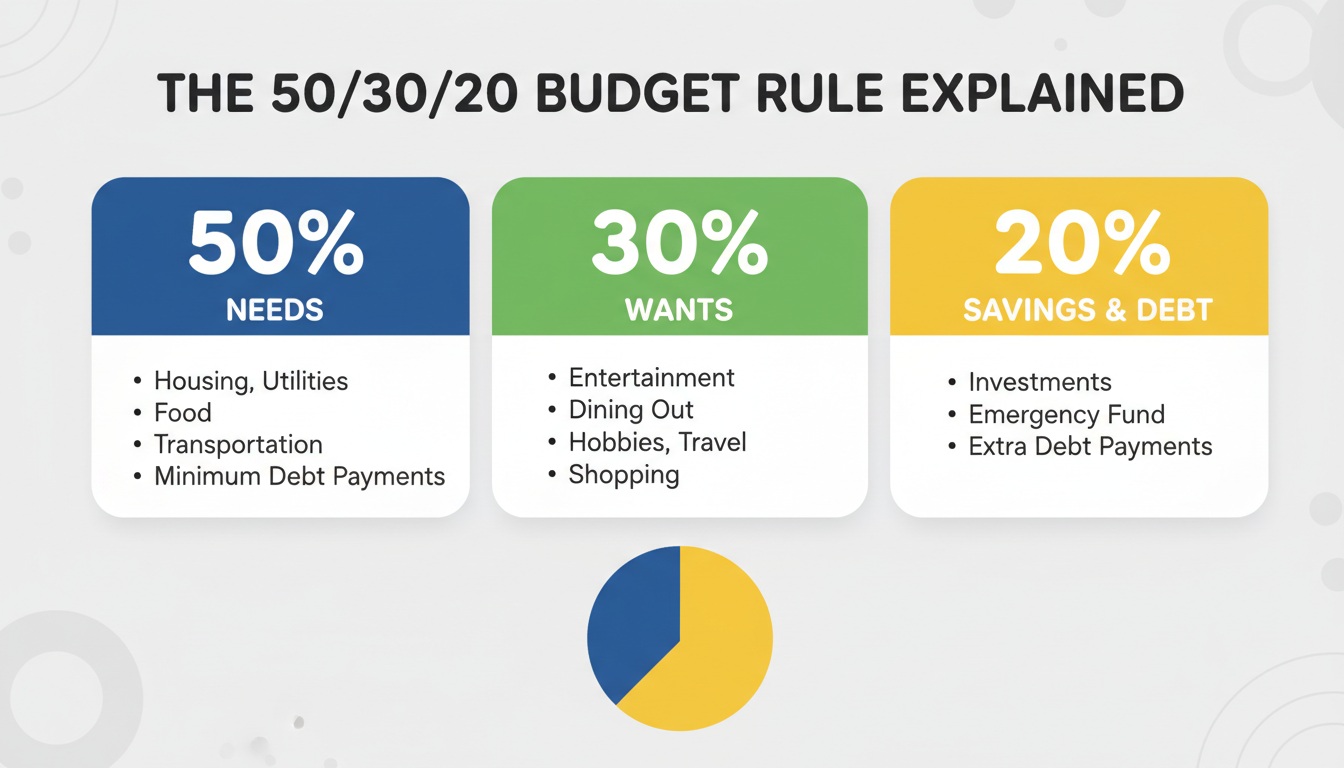

The 50-30-20 Rule Simplified: Your Money Framework

Let’s start with a simple framework that works no matter your income level.

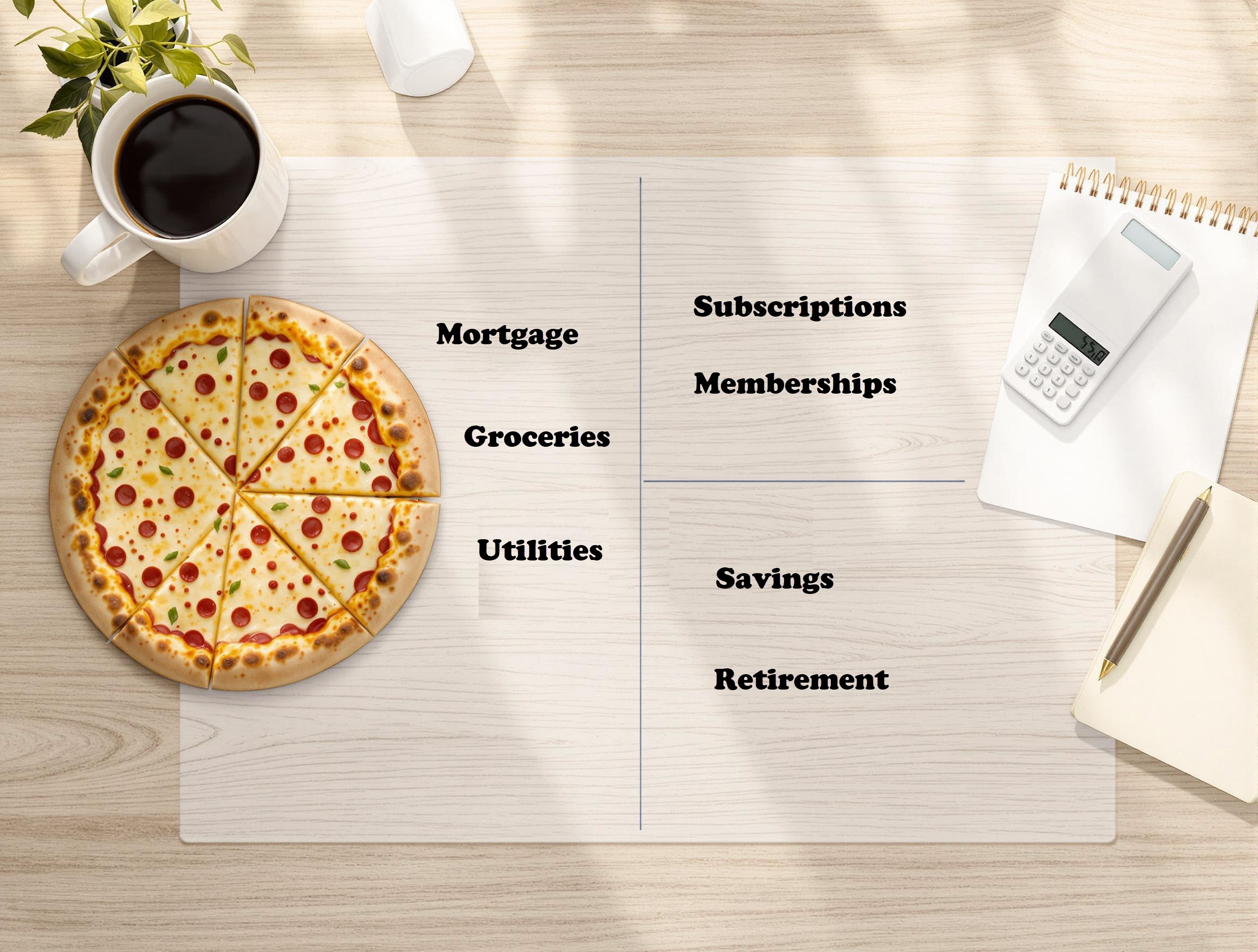

Imagine your paycheck is a pizza already sliced into three pieces:

- 50% for Needs (the biggest slice) – Rent, mortgage, utilities, groceries, transportation, insurance

- 30% for Wants (the medium slice) – Entertainment, dining out, hobbies, subscriptions

- 20% for Your Future (the smallest slice) – Savings, debt payoff, investments, emergency fund

Here’s what “emergency fund” means: Money you set aside in a separate savings account for unexpected expenses. Car repairs. Medical bills. Job loss. Think of it as financial insurance. Most experts recommend 3-6 months of living expenses, but start with $500-$1,000 and build from there.

Real example: If you make $3,000 per month:

- $1,500 goes to needs

- $900 goes to wants

- $600 goes to your future (savings and debt payoff)

If you make $6,000 per month:

- $3,000 goes to needs

- $1,800 goes to wants

- $1,200 goes to your future

The percentages stay the same. Your numbers just scale up.

Pro Tip: If your current spending doesn’t match these percentages, don’t panic. You’re not alone. We’ll fix it step by step.

Weekly Money Check-Ins: Your New Money Habit

Just like checking your weight or blood pressure, your finances need regular attention. Set aside 30 minutes every Sunday evening to review your spending and adjust course if needed.

Think of this like a workout log, but for your money. No fancy systems required—just the basics to keep you on track.

How to Run Your Weekly Money Check-In

Step 1: Review Your Recent Transactions

Pull up your bank account and credit card statements. Look at the past week’s spending. What stands out? Did you overspend in any category?

Step 2: Quick Numbers Check

Add up what you spent on needs, wants, and savings. Are you tracking toward your 50-30-20 targets?

Step 3: Progress Tracker

Write down one win from the week (no matter how small). Packed lunch instead of eating out? Skipped an impulse purchase? Logged your spending? That counts.

Step 4: Next Week’s Game Plan

Identify one area where you can improve next week. Just one. Not five. One.

Remember: The goal isn’t perfection. Just like skipping one workout won’t ruin your fitness, one overspending week won’t destroy your finances. It’s about staying aware and making adjustments as needed.

Common Money Mistakes You Might Be Making

Let’s look at the patterns that keep men stuck financially—and how to break them.

Mistake #1: The “I’ll Start Tomorrow” Syndrome

We’ve all been there—pushing off financial planning because it feels overwhelming. But here’s the truth: every day you wait is money left on the table.

The fix: Start today. Not Monday. Not next month. Today. Pick one thing from this checklist and do it right now. Open a savings account. Track your spending for one day. That’s it.

Why it works: You break the mental barrier. Once you start, continuing gets easier.

Mistake #2: Emotional Spending

That new gadget feels good today. That luxury car seems like you “deserve it.” But will it help you reach financial independence?

The real question: Before any major purchase, wait 48 hours and ask yourself: “Does this align with my financial goals?”

Real example: Instead of buying the $60,000 luxury SUV because “you deserve it,” consider a reliable $30,000 vehicle and invest the difference. In 10 years, that $30,000 invested wisely could grow to $50,000-$60,000+, while the luxury car will be worth a fraction of its original price.

The pattern: Most people living the “high life” are actually drowning in debt. You don’t see their financial statement—just their Instagram photos.

Mistake #3: The “I’ll Figure It Out Later” Retirement Plan

Think of retirement planning like training for a marathon. You wouldn’t wait until the week before to start training, right?

Many men in their 40s push off retirement planning, thinking they have plenty of time. But here’s the reality: starting now, even with small steps, is better than perfect planning tomorrow.

Quick fix: If your employer offers a 401(k) match, start contributing enough to get the full match. That’s free money. If not, open a Roth IRA and contribute what you can. Even $100/month adds up.

What’s a 401(k)? It’s a retirement savings account your employer offers. You contribute money before taxes, and it grows over time. Many employers will match what you contribute (free money!). A Roth IRA is similar but you open it yourself through a bank or investment company.

Mistake #4: The “Keeping Up With the Joneses” Trap

Your neighbor just got a new boat. Your colleague is talking about their investment property. But here’s what you don’t see: their financial statement.

The truth: Comparison kills progress. Focus on your own financial goals, not someone else’s lifestyle.

Strategic Debt Elimination: The Smart Approach

Debt isn’t always bad (mortgage debt can build wealth), but high-interest debt (credit cards, personal loans) holds you back.

Two popular strategies:

Debt Snowball: Pay off smallest debts first for quick wins and motivation.

Debt Avalanche: Pay off highest-interest debts first to save the most money.

Pick whichever keeps you motivated. Consistency matters more than perfection.

Learn more: Check out our detailed guide on Debt Snowball vs Avalanche to dive deeper into which method works best for your situation.

Related Articles:

Tools That Make Money Management Easier

You don’t need fancy software. But these tools can help you stay on track without overthinking it.

Budgeting Apps for Beginners

YNAB (You Need A Budget)

- Great for: People who want to track every dollar

- Cost: Free trial, then $15/month

- Why it works: Forces you to be intentional with money

Empower (formerly Personal Capital)

- Great for: Seeing all your money in one place

- Cost: Free version available

- Why it works: Connects to all your accounts automatically

Simple Spreadsheet

- Great for: People who like control and simplicity

- Cost: Free (Google Sheets or Excel)

- Why it works: You see exactly what you’re doing with your money

Investment Platforms

Vanguard

- Great for: Long-term investors who want low fees

- Why it works: Simple, straightforward, trusted for decades

Fidelity

- Great for: Beginners and experienced investors

- Why it works: Great customer service and educational resources

Clever Fox Budget Planner - Expense Tracker Notebook

Identifying Thought Patterns That Hold You Back

Your mindset about money matters. If you believe “I’ll never be good with money,” you probably won’t be.

Common limiting beliefs:

- “I’m too old to start investing”

- “I don’t make enough money”

- “Money management is too complicated”

- “I’m just bad with money”

The truth: These are just thoughts, not facts. And thoughts can change.

Learn more: Dive deeper into Identifying Thought Patterns That Hold You Back to reprogram the money beliefs sabotaging your progress.

Your 4-Week Money Reset Action Plan

Start with one week. Then move to the next. Small, consistent progress beats perfect planning every time.

Week 1: Track Every Dollar

Yes, even that coffee. Even that $3 snack. Write it down or use an app.

Why: You can’t manage what you don’t measure. This week is about awareness, not judgment.

Moleskine Classic Notebook

Week 2: Set Up Automatic Savings

What this means: Your bank automatically moves money from checking to savings each payday. You don’t have to think about it.

How to start: Log into your bank and set up an automatic transfer for $25-$100 per paycheck (whatever you can afford). It happens automatically, so you won’t miss it.

Why it works: You can’t spend money that’s not in your checking account. This builds the savings habit painlessly.

Week 3: Review and Optimize Your Bills

Call your insurance company. Check your subscriptions. Renegotiate your internet bill. Small savings add up.

Real example: Lowering your insurance premium by $20/month = $240/year. That’s money for your future self.

Week 4: Create Your Investment Strategy

This doesn’t mean you need to be a stock market expert. Start simple.

What’s an investment strategy? A plan for where your money goes to grow over time. For most people starting out: a retirement account (like a 401k) or a low-cost index fund. You’re not trying to beat the market—just grow your money steadily.

The Bogleheads' Guide to Investing

The Mental Game of Money: Building Resilience in Your Prime Years

Here’s something most financial advice misses: your mindset is everything.

You can have the perfect budget, but if you don’t believe you deserve financial success, you’ll sabotage yourself. You’ll make impulsive purchases. You’ll avoid checking your bank account. You’ll procrastinate on important money decisions.

Learn more: Our guide on The Mental Game of Change: Building Resilience in Your Prime Years walks you through the psychological shifts that make financial success stick.

Connecting Money to Your Bigger Life Goals

Money isn’t the goal. Freedom is. Time with family. Reduced stress. Options.

When you reset your finances, you’re not just moving numbers around. You’re building the foundation for the life you actually want.

Learn more: Check out The Power of Progressive Mindset: Small Wins to Major Breakthroughs to see how financial wins connect to your overall life transformation.

Your Next Steps: Start This Week

You don’t need to do everything at once. Pick one thing and start today.

This week:

This month:

This quarter:

Related Reading & Resources

Deepen Your Financial Foundation:

- Passive Income Foundations: Starting Your Side Hustle at 40+ – Ready to build additional income streams?

- The $100 Budget That Can Change Your Life – Learn how small budget adjustments create big results

- Sunday Financial Review: Weekly Money Check-In System – A detailed system for your weekly money habits

- September Financial Check-In: Q3 Money Moves for Men Over 40 – Seasonal financial planning strategies

Strengthen Your Mindset:

- Identifying Thought Patterns That Hold You Back – Reprogram limiting beliefs about money

- The Mental Game of Change: Building Resilience in Your Prime Years – Psychology of financial success

- The Power of Progressive Mindset: Small Wins to Major Breakthroughs – How small wins compound into transformation

The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich

Final Thoughts: Progress Over Perfection

Financial success isn’t about making perfect decisions. It’s about consistent progress.

You’re going to mess up. You’ll overspend some weeks. You’ll skip a money check-in. That’s normal. What matters is getting back on track.

“Success is the sum of small efforts repeated day in and day out.”

– Robert Collier

Every dollar you save is a dollar working for your future. Every week you stay aware is progress. Every small decision compounds into real change.

You’ve got this. Start today.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Important Note: The information provided in this article is for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making significant financial decisions. Your situation is unique, and these general guidelines may need to be adjusted to your specific circumstances.