Mental Resilience & Money: How Your Mindset Shapes Financial Decisions After 40

Ever notice how you make different money decisions when you’re stressed versus when you’re calm? Maybe you’ve impulse-bought something expensive after a rough day, or avoided checking your bank account when you’re anxious. That’s not a character flaw—it’s your brain under pressure. And here’s the good news: once you understand how mental resilience and financial decisions are connected, you can start making smarter money choices, no matter where you’re starting from.

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.”

– Will Rogers

Look, we’ve all been there. You’re having a terrible week at work, and suddenly that $200 pair of shoes or that $50 takeout order feels justified. Or maybe you’re on the other end—so stressed about money that you can’t even bring yourself to open your banking app. Your mental state and your wallet are more connected than most people realize.

Today, we’re diving into how building mental strength can transform the way you handle money—whether you’re working with $50 a month or $5,000. No fancy financial jargon, no complicated theories. Just practical strategies that work for real guys dealing with real life.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Why Mental Resilience and Financial Decisions Go Hand-in-Hand

Here’s something nobody talks about enough: your mental state directly affects your bank account. When you’re mentally strong and balanced, you make clearer choices about money. When you’re stressed, anxious, or overwhelmed, your brain goes into survival mode—and that’s when bad financial decisions happen.

Think about it this way: your brain has two modes when it comes to decisions. There’s the calm, logical mode where you can weigh options and think long-term. Then there’s the stressed-out mode where everything feels urgent and you just want relief right now. That second mode? That’s where impulse purchases live. Where you avoid dealing with bills. And where you make choices your future self regrets.

The mind-money connection works like this:

When you’re mentally resilient (meaning you can stay calm and think clearly even when life gets tough), you’re better at:

- Resisting impulse purchases that feel good in the moment but hurt later

- Sticking to budgets and savings goals even when it’s boring or hard

- Making investment decisions based on logic, not fear or hype

- Facing financial problems head-on instead of avoiding them

- Thinking long-term instead of just solving today’s stress

This isn’t just theory. Research shows that people who practice stress management techniques make fewer impulse purchases and stick to their financial plans more consistently. Your mental fitness is just as important as your financial literacy—maybe even more so.

If you want to understand how all three pillars of your life work together, check out The Triangle of Well-being: How Health, Mind, and Money Connect. It breaks down why you can’t fix your finances without addressing your mindset.

The Real Cost of Stress on Your Wallet

Let’s get specific about how stress actually drains your bank account. This isn’t abstract—it’s happening to most of us without us even realizing it.

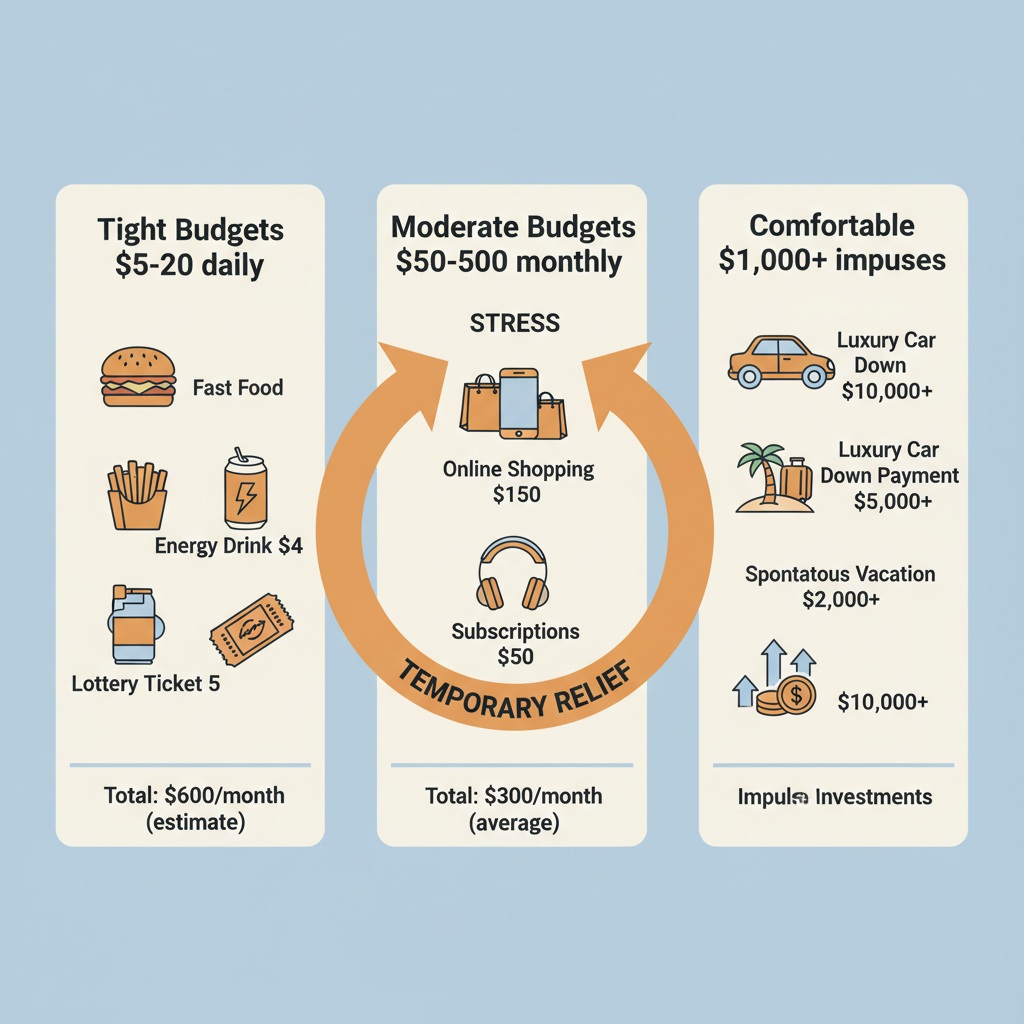

The Stress-Spending Cycle

For tight budgets ($5-20 daily):

You’re stressed about money, so you grab fast food instead of cooking ($12). You’re tired from worrying, so you buy an energy drink ($4). You need a mood boost, so you grab a lottery ticket ($5). That’s $21 in one day—over $600 a month—on things that don’t actually solve the problem.

For moderate budgets ($50-500 monthly):

Bad day at work? Online shopping therapy. Relationship stress? New gadgets or clothes. Anxiety about the future? Subscriptions you don’t use but feel good signing up for. Before you know it, you’ve spent $300 on stuff you barely remember buying.

For comfortable earners ($1,000+ impulses):

Stress manifests differently here. Maybe it’s the upgraded car you don’t need. The vacation booked on impulse. The investment made because everyone else is doing it and you’re afraid of missing out. Higher income doesn’t mean immunity to stress spending—it just means bigger numbers.

Real example: Mike, a 48-year-old electrician, realized he was spending $40-60 every Friday on takeout and beer after stressful work weeks. He wasn’t even enjoying it that much—it was just automatic. Once he recognized the pattern, he started a simple Friday wind-down routine at home (more on routines below) and redirected that $200/month into an emergency fund. Eighteen months later, he had $3,600 saved. Same income, different mental approach.

The Avoidance Tax

Here’s another way stress costs you money: avoidance. When you’re anxious about your finances, you might:

- Avoid checking your bank account (leading to overdraft fees)

- Ignore bills until they’re late (hello, late fees and interest)

- Put off dealing with debt (letting interest compound)

- Skip reviewing subscriptions (paying for stuff you don’t use)

- Avoid negotiating better rates (on insurance, phone plans, etc.)

This “avoidance tax” can cost you hundreds or even thousands annually. And it all stems from not having the mental resilience to face uncomfortable financial realities.

For more on breaking through mental barriers that keep you stuck, read You’re Not Too Old: Defeating the Inner Critic in Your 40s and 50s. That inner voice telling you to avoid your finances? You can shut it down.

Three Core Strategies to Build Financial Mental Resilience

Alright, enough about the problem. Let’s talk solutions. These three strategies work whether you’re making $35k or $135k a year. The principles are the same.

Strategy #1: The Morning Money Mindset Routine

Your morning sets the tone for your entire day—including how you handle money decisions. A solid morning routine builds the mental resilience you need to make smart financial choices all day long.

Here’s a simple 15-minute routine:

5 minutes: Mental clarity practice

This doesn’t have to be formal meditation. Just sit quietly with your coffee and take deep breaths. No phone, no TV, just you and your thoughts. This trains your brain to stay calm under pressure—a skill that directly translates to better money decisions.

If you’re new to this, grab a copy of Atomic Habits by James Clear. It’s the best book I’ve found for building small habits that stick. The chapter on habit stacking is gold for creating morning routines.

5 minutes: Financial check-in

Open your banking app. Just look. You don’t have to do anything—just observe where you stand. This removes the fear and avoidance. Over time, this simple act makes you more comfortable with your financial reality, which means you’ll make better decisions throughout the day.

5 minutes: Intention setting

Ask yourself: “What’s one smart money choice I can make today?” Maybe it’s bringing lunch instead of buying it. Maybe it’s finally calling about that insurance rate. Maybe it’s just not impulse-buying. One intention, clearly stated.

Why this works: You’re training your brain to stay calm around money topics and to think intentionally rather than reactively. That’s mental resilience in action.

Want a complete system for weekly financial check-ins? Check out Sunday Financial Review: Weekly Money Check-In System. It pairs perfectly with this morning routine.

Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

Atomic Habits by James Clear breaks down how tiny mindset changes compound into major transformations. It's written in plain English—no psychology degree needed.

Strategy #2: The 24-Hour Decision System

Here’s a simple rule that’ll save you thousands: before any purchase over $100, wait 24 hours and ask yourself three questions.

The Three Questions:

- Am I calm right now? If you’re stressed, angry, anxious, or overly excited, your brain isn’t in decision-making mode—it’s in reaction mode. Wait until you’re neutral.

- Have I slept well recently? Sleep deprivation destroys decision-making ability. If you’re running on 5 hours of sleep, you’re not equipped to make good money choices. Period.

- Is this solving a real problem or an emotional one? Be honest. Are you buying this because you genuinely need it, or because buying it will make you feel better temporarily?

Real example: Tom, a 52-year-old teacher, almost bought a $1,200 fishing kayak after a particularly frustrating week at school. He implemented the 24-hour rule. The next day, rested and calmer, he realized he’d only been fishing twice in the past year. He didn’t buy it. That’s $1,200 saved by simply waiting and asking questions.

For bigger decisions (over $1,000): Extend this to 72 hours or even a week. The bigger the purchase, the more time you need to let emotions settle and logic take over.

Keep a small notebook for this—We recommend the Moleskine Classic Notebook. When you’re tempted to buy something, write down what it is, why you want it, and the date. Come back to it after 24 hours. You’ll be amazed how many “must-haves” become “what was I thinking?”

Use a basic notebook or the Moleskine Classic Notebook to jot down your answers. Sometimes, writing it down makes it real.

Strategy #3: Stress Management for Money Decisions

You can’t eliminate stress—life happens. But you can build tools to manage it so it doesn’t wreck your finances.

Quick stress-reset techniques (use these before any money decision):

The 5-5-5 Breathing Method

Breathe in for 5 counts, hold for 5 counts, breathe out for 5 counts. Repeat 5 times. This physically calms your nervous system and shifts your brain out of panic mode. Takes 2 minutes, costs nothing, works every time.

The Reality Check

Ask yourself: “Will this matter in 5 years?” Most impulse purchases won’t. Most financial stressors that feel huge today will be forgotten. This perspective helps you make decisions based on long-term goals, not short-term emotions.

The Phone-a-Friend Option

Identify one person in your life who’s good with money and level-headed. Before making any major financial decision while stressed, call them. Just talking it through with someone who’s not emotionally invested can provide clarity.

Physical movement

This might sound weird, but physical activity directly impacts financial decision-making. When you’re stressed, your body is flooded with cortisol (the stress hormone). Exercise burns it off. A 10-minute walk before making a money decision can literally change the outcome.

For more on how physical wellness impacts your financial decisions, read Health & Wealth: How Physical Wellness Impacts Your Financial Future. The connection is stronger than you think.

Tool recommendation: Get a simple stress ball or grip strengthener like this one from IronMind. Keep it at your desk. When you’re about to make a financial decision and feel stressed, squeeze it for 2 minutes while doing the 5-5-5 breathing. It gives your hands something to do and helps discharge nervous energy.

Captains of Crush Hand Gripper Point Five - (120 lb.)

Building Long-Term Financial Mental Resilience

Okay, so you’ve got your morning routine, your decision system, and your stress management tools. Now let’s talk about building lasting mental resilience that transforms your entire relationship with money.

Create Your Financial Comfort Zone

Most people avoid their finances because they’ve never built comfort around money topics. Here’s how to change that:

Weekly money dates (15 minutes)

Every Sunday (or whatever day works), sit down with your finances. Review your accounts, check your budget, look at upcoming expenses. Do this even when—especially when—you don’t want to.

The goal isn’t to solve every problem. The goal is to build familiarity and comfort. Over time, money stops being this scary, stressful thing and becomes just another part of life you manage.

Education without overwhelm

You don’t need to become a financial expert. But learning basic concepts reduces anxiety and improves decisions. Start with one book or resource at a time.

We recommend The Psychology of Money by Morgan Housel. It’s not a typical finance book—it’s about how people think about money, which is exactly what we’re talking about here. Easy read, powerful insights.

Celebrate small wins

Mental resilience grows when you acknowledge progress. Paid off $100 of debt? That’s worth recognizing. Stuck to your budget for a week? Celebrate it. Resisted an impulse purchase? Give yourself credit.

These small wins build confidence, which builds resilience, which leads to better financial decisions. It’s a positive cycle.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Address the Root Causes

Sometimes poor financial decisions aren’t really about money—they’re about unresolved stress, anxiety, or other life issues. If you find yourself consistently making money choices you regret, it might be time to dig deeper.

Free and low-cost resources:

- Library books on personal finance and stress management

- YouTube channels (Graham Stephan, The Financial Diet, etc.)

- Community workshops at libraries or community centers

- Free financial counseling through nonprofits like NFCC

When to consider professional help:

If financial stress is affecting your sleep, relationships, or health, talking to a therapist who specializes in financial anxiety can be worth it. Many offer sliding scale fees based on income.

And look, if professional help isn’t in the budget right now, that’s okay. The strategies in this post cost nothing but commitment. Start there.

For a deeper dive into managing stress during major life changes (which often trigger financial stress), check out From Overwhelm to Clarity: A Strategic Approach to Life Transitions.

The Compound Effect of Mental Resilience

Here’s the beautiful thing about building mental resilience for financial decisions: it compounds over time, just like interest.

Month 1: You avoid one $150 impulse purchase because you used the 24-hour rule.

Month 3: You’re consistently checking your accounts without anxiety, so you catch and cancel a $15/month subscription you forgot about.

Month 6: You negotiate a better rate on your car insurance because you’re calm enough to make the call, saving $40/month.

Month 12: You’ve built an emergency fund because you’ve been making consistent, calm decisions instead of reactive ones.

Year 2: You’re investing regularly because you’re not panicking during market dips. You’re making strategic career moves because you’re thinking clearly about money.

None of these require a higher income. They all require mental resilience and financial decisions working together.

Related Articles:

Your Next Steps: Taking Action Today

Alright, let’s make this concrete. Here’s what to do right now:

Today:

- Set up your morning routine for tomorrow (just 15 minutes—you can do this)

- Identify your biggest stress-spending trigger (what emotion makes you reach for your wallet?)

- Put a 24-hour rule reminder in your phone for purchases over $100

This Week:

- Schedule your first Sunday financial check-in

- Order one of the books mentioned above (or get it from the library)

- Practice the 5-5-5 breathing method three times

This Month:

- Track one full week of spending and note your emotional state with each purchase

- Identify one financial task you’ve been avoiding and tackle it

- Celebrate one financial win, no matter how small

Building mental resilience for better financial decisions isn’t about perfection—it’s about progress. Every time you pause before an impulse purchase, you’re building that resilience. Every time you check your account instead of avoiding it, you’re getting stronger. Every time you make a calm, intentional choice about money, you’re changing your financial future.

And here’s the thing: this works whether you’re trying to save your first $500 or your next $50,000. The principles are the same. Your brain doesn’t care about the dollar amount—it cares about the patterns you build.

Common Questions About Mental Resilience and Money

Final Thoughts

Look, here’s the truth: you can read every personal finance book ever written, follow every budget template, and know every investment strategy—but if you can’t manage your mental state, you’ll still make poor financial decisions.

Mental resilience and financial decisions are inseparable. Your mindset is the foundation everything else is built on. Get that right, and the rest becomes so much easier.

The good news? You don’t need to be perfect. You don’t need to never feel stressed. You just need to build enough mental strength to make good choices even when you don’t feel like it. That’s what resilience means—not the absence of stress, but the ability to function well despite it.

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make.”

– Dave Ramsey

Start with one thing from this post. Just one. Maybe it’s the morning routine. Maybe it’s the 24-hour rule. Maybe it’s just the breathing technique. Pick one, commit to it for two weeks, and watch what happens.

You’ve got this. Your financial future isn’t determined by how much you make—it’s determined by the decisions you make. And now you’ve got the tools to make better ones.

Ready to dive deeper into building unshakeable mental strength? Check out The Hidden Psychology of Male Success After 40: A Practical Guide to Mental Resilience and Lasting Change. It’s the complete roadmap for developing the mindset that transforms every area of your life—including your wallet.

And if you’re ready to take action on building additional income streams (because mental resilience also means having the courage to pursue opportunities), read Passive Income 101: Starting Your Side Hustle After 40.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Important note: The information provided in this post is for educational and informational purposes only. While we’ve spent over a decade studying health, wellness, and financial strategies, we are not a licensed healthcare provider, mental health professional, or financial advisor. Everyone’s situation is unique, so what works for one person might not work for another. For physical health matters, always consult your doctor before starting any new fitness program. For mental health concerns, please seek qualified mental health professionals. For financial decisions, consult with certified financial advisors who can assess your specific situation. The content here reflects personal research and experience but shouldn’t replace professional advice in any of these areas. By reading and using this information, you’re taking responsibility for your own decisions. Your health, mind, and money deserve professional guidance when needed. Stay awesome!