Passive Income Foundations: Starting Your Side Hustle at 40+

Feeling that nudge to build something on the side, but worried it might be too late? Let me tell you straight up – starting a side hustle after 40 isn’t just possible, it’s actually your advantage window.

You might be thinking, “I’m too old to start something new” or “I don’t have time with my full-time job and family.” Here’s the reality: your 40s and 50s are actually your advantage years. You have skills younger people are still developing, professional networks they haven’t built, and judgment that only comes with experience. You don’t need to quit your job or work 80-hour weeks—you need a smart, focused approach that fits your life right now.

“The best time to plant a tree was 20 years ago. The second best time is now.”

— Chinese Proverb

As someone in their 40s, you have serious advantages. You bring experience, judgment, and likely some savings to work with. Let’s break down how to get started without the usual overwhelming jargon.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Why Starting a Side Hustle After 40 Is Your Advantage

Building extra income streams isn’t just about making more money – it’s about creating freedom and security. Think of it as planting trees; the best time to start was 20 years ago, but the second-best time is now.

Passive income means money you earn with minimal ongoing effort—think of it like planting a garden once and harvesting vegetables all season long. That’s what we’re building here.

Your 40s bring three critical advantages younger entrepreneurs don’t have:

1. Experience That Pays

You’ve spent 20+ years building skills people will pay for. Whether it’s Excel wizardry, project management, home repair knowledge, or cooking expertise – you have marketable knowledge.

2. Professional Networks

You know people. Your contacts from past jobs, industry connections, and community relationships are gold for starting a side business.

3. Financial Judgment

You’ve made money mistakes and learned from them. You understand budgets, risk, and the value of a dollar better than most 25-year-olds.

Meet Tom, a 47-year-old accountant who created budget tracking templates for small businesses. He spent three weekends building five templates, listed them on Etsy for $15 each, and now earns $300-500 monthly while sleeping. No fancy tech skills required—just Excel knowledge he already had.

Quick Win #1:

This week, spend 30 minutes listing three skills you have that others frequently ask you about. That’s your starting point.

Low-Risk Side Business Ideas That Fit Your Schedule

The key to balancing work, life, and a side hustle is choosing the right model. Let’s break down options by your starting budget and available time.

For Those Starting With Limited Funds ($0-$100)

Freelance Consulting or Coaching

Turn your career expertise into paid advice. If you’ve managed teams, projects, or departments, others will pay for that knowledge.

- Time investment: 5-10 hours/week

- Potential earnings: $50-150/hour

- Getting started: Create a simple profile on Upwork or LinkedIn, reach out to 10 contacts

Digital Product Creation

Create templates, guides, or checklists once and sell them repeatedly.

- Examples: Excel templates, meal plans, workout routines, budget spreadsheets

- Platforms: Etsy, Gumroad, Teachable

- Startup cost: $0-50

The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future

Content Creation

Start a YouTube channel, blog, or podcast in your area of expertise.

- Monetization: Ads, sponsorships, affiliate marketing

- Timeline to income: 6-12 months

- Best for: Patient builders who enjoy teaching

For Those With Moderate Investment Capacity ($100-$1,000)

Print-on-Demand Merchandise

Design t-shirts, mugs, or posters without holding inventory. Services like Printful handle production and shipping.

- Startup cost: $100-300 for design tools and samples

- Time to first sale: 2-4 weeks

- Scalable: Yes – create once, sell repeatedly

Online Course Creation

Package your expertise into a structured learning experience.

- Platforms: Teachable, Udemy, Skillshare

- Investment: $200-500 for equipment (microphone, lighting)

- Potential: $500-5,000/month once established

Logitech For Creators Blue Yeti Nano USB Microphone

Local Service Business

Leverage physical skills without breaking your back.

- Examples: Lawn care consulting, handyman services, personal training

- Investment: $300-800 for basic tools and marketing

- Quick to revenue: Often within first month

For Those With Higher Investment Capacity ($1,000+)

Rental Income Opportunities

Rent a spare room, parking space, or storage area.

- Investment: $1,000-3,000 for setup and legal compliance

- Monthly income: $300-1,500 depending on location

- Passive level: High once established

Dividend-Focused Investing

Build income through strategic stock investments.

- Starting amount: $1,000-5,000

- Expected return: 3-7% annually in dividends

- Best for: Patient wealth builders

The Intelligent Investor Rev Ed.: The Definitive Book on Value Investing

Purchasing Established Online Businesses

Buy a profitable website or e-commerce store with proven revenue.

- Investment: $2,000-10,000+

- Platforms: Flippa, Empire Flippers

- Risk level: Medium – requires due diligence

James, 52, started offering lawn care consultations via Zoom for $50/hour on weekends. He leveraged 20 years of gardening experience without breaking his back doing physical labor. First month: 4 clients. Six months later: 15 regular clients and $3,000/month extra income.

Your 4-Week Side Hustle Launch Plan

Starting a side hustle after 40 requires a strategic approach. Here’s your step-by-step roadmap.

Week 1-2: Research Phase

Identify Your Marketable Skills

List everything you’re good at – even things that seem obvious. Your “normal” is someone else’s expertise.

- Career skills (management, sales, technical)

- Hobby expertise (woodworking, cooking, fitness)

- Life experience (parenting, home ownership, budgeting)

Research Market Demand

Don’t guess – validate. Spend time on:

- Upwork and Fiverr (what services are people buying?)

- Etsy and Amazon (what products are selling?)

- Facebook groups in your niche (what problems do people ask about?)

Evaluate Your Time Reality

Be honest about your schedule. Managing your energy effectively is more important than finding more hours.

- How many hours weekly can you realistically commit?

- When is your peak energy time? (Use it for your side hustle)

- What can you reduce or eliminate to make room?

Quick Win #2:

This week, create one simple offering and tell five people about it. Don’t overthink it—test and adjust.

Week 3-4: Foundation Building

Set Up Your Business Basics

Keep it simple initially:

- Business name: Use your own name if unsure

- Simple website or profile: Carrd.co (free), LinkedIn, or platform-specific profiles

- Payment method: PayPal, Venmo, or Stripe

- Basic tracking: Simple spreadsheet for income and expenses

The One Page Business Plan for the Creative Entrepreneur: The Fastest, Easiest Way to Write a Business Plan

Create Your First Offer

Start with one clear service or product:

- What specific problem does it solve?

- Who exactly is it for?

- What’s the price? (Research competitors, then price slightly lower initially)

- What’s included and what’s not?

Build Your Minimum Viable Presence

You don’t need perfection – you need visibility:

- LinkedIn profile updated with your new offering

- One social media post explaining what you do

- Email to 10-20 contacts letting them know you’re available

- Simple one-page website or landing page

Risk Assessment Made Simple

“Risk assessment” simply means asking yourself: “What could go wrong, and can I handle it?”

- If you invest $500 in equipment, could you afford to lose that money?

- If you spend 10 hours weekly for 3 months with no income, is that acceptable?

- What’s your backup plan if this doesn’t work?

Understanding the psychology behind your financial decisions helps you make smarter choices about which side hustle to pursue.

Time-Efficient Models That Actually Work

The biggest concern for men over 40 starting a side hustle is time. You’ve got a full-time job, family responsibilities, and maybe aging parents to care for. Here’s how to build income without sacrificing everything else.

The “Low-Cost, Low-Time” Method

This approach requires minimal upfront investment and can fit into 5-10 hours weekly.

For example, if you’re skilled at Excel:

Create five specialized templates (budget trackers, project planners, inventory systems), list them on Etsy for $10-20 each, and market them through LinkedIn posts and relevant Facebook groups. Total setup time: 20-30 hours. Ongoing time: 2-3 hours weekly for customer service and marketing.

Scalable means your business can grow without requiring dramatically more of your time. For example, creating an online course is scalable—whether 10 or 1,000 people buy it, you create it once.

For consulting or coaching:

Offer two-hour strategy sessions on weekends. Limit yourself to 4-6 clients monthly. At $100-200 per session, that’s $400-1,200 monthly for 8-12 hours of work.

For content creation:

Batch-create content. Spend one Sunday afternoon creating four weeks of social media posts, blog articles, or YouTube videos. Use scheduling tools to automate posting.

Deep Work: Rules for Focused Success in a Distracted World

How Much Time Does This Really Take?

Let’s be realistic about time investment:

Research & Setup Phase (Weeks 1-4):

- 10-20 total hours spread across one month

- Can be done in 2-3 hour blocks on weekends

Launch Phase (Months 1-3):

- 5-10 hours weekly

- Includes marketing, client work, and refinement

Maintenance Phase (Months 4+):

- 3-5 hours weekly once systems are established

- Focus shifts to optimization and growth

How to Start a Side Hustle Without Neglecting Your Family

This is crucial. Your family comes first, and your side hustle should enhance your life, not strain it.

Set Clear Boundaries:

- Designate specific work times (e.g., Saturday mornings, weekday evenings after kids’ bedtime)

- Communicate your schedule with your family

- Protect family time – no side hustle work during dinner or family activities

Involve Your Family:

- Share your goals and progress

- Ask for their input and support

- Consider age-appropriate ways kids can help

- Celebrate milestones together

Use “Dead Time” Strategically:

- Lunch breaks for administrative tasks

- Commute time for learning (audiobooks, podcasts)

- Waiting rooms for email responses

Building sustainable habits across all areas of your life ensures your side hustle supports rather than sabotages your wellbeing.

Quick Win #3:

This week, make your first ask. Post on social media, email your network, or list your service on one platform.

Resource Requirements Breakdown

Let’s talk real numbers. What will starting a side hustle after 40 actually cost you?

Time Investment

Minimum viable commitment: 5 hours weekly

Optimal for growth: 10-15 hours weekly

Aggressive building: 20+ hours weekly

Most successful side hustles for men over 40 start with 5-10 hours weekly and scale up as revenue justifies the time investment.

Financial Investment

Bare minimum: $0-100

- Freelance services require only your time

- Digital products need free tools (Canva, Google Docs)

- Consulting needs only a phone and calendar

Moderate investment: $100-500

- Basic equipment (microphone, camera, tools)

- Website and domain ($50-150 annually)

- Marketing and advertising ($100-200 initially)

Comfortable launch: $500-2,000

- Professional equipment and software

- Inventory or initial product development

- Marketing budget for faster growth

- Legal setup (LLC, business licenses)

Related Articles:

Three Legal Things to Know Before You Start

Don’t let legal concerns paralyze you, but don’t ignore them either.

1. Register Your Business Name (If Needed)

If you’re using your own name (John Smith Consulting), you typically don’t need registration. If you’re creating a business name (Smith Solutions LLC), you’ll need to register it with your state.

- Cost: $50-150 depending on state

- Time: 1-2 hours online

- When: Before you start marketing under that name

2. Track All Expenses for Tax Deductions

Every dollar you spend on your side hustle can potentially reduce your tax bill.

Deductible expenses include:

- Equipment and supplies

- Software subscriptions

- Marketing and advertising

- Home office space (if you have a dedicated area)

- Mileage for business-related driving

- Education and training related to your business

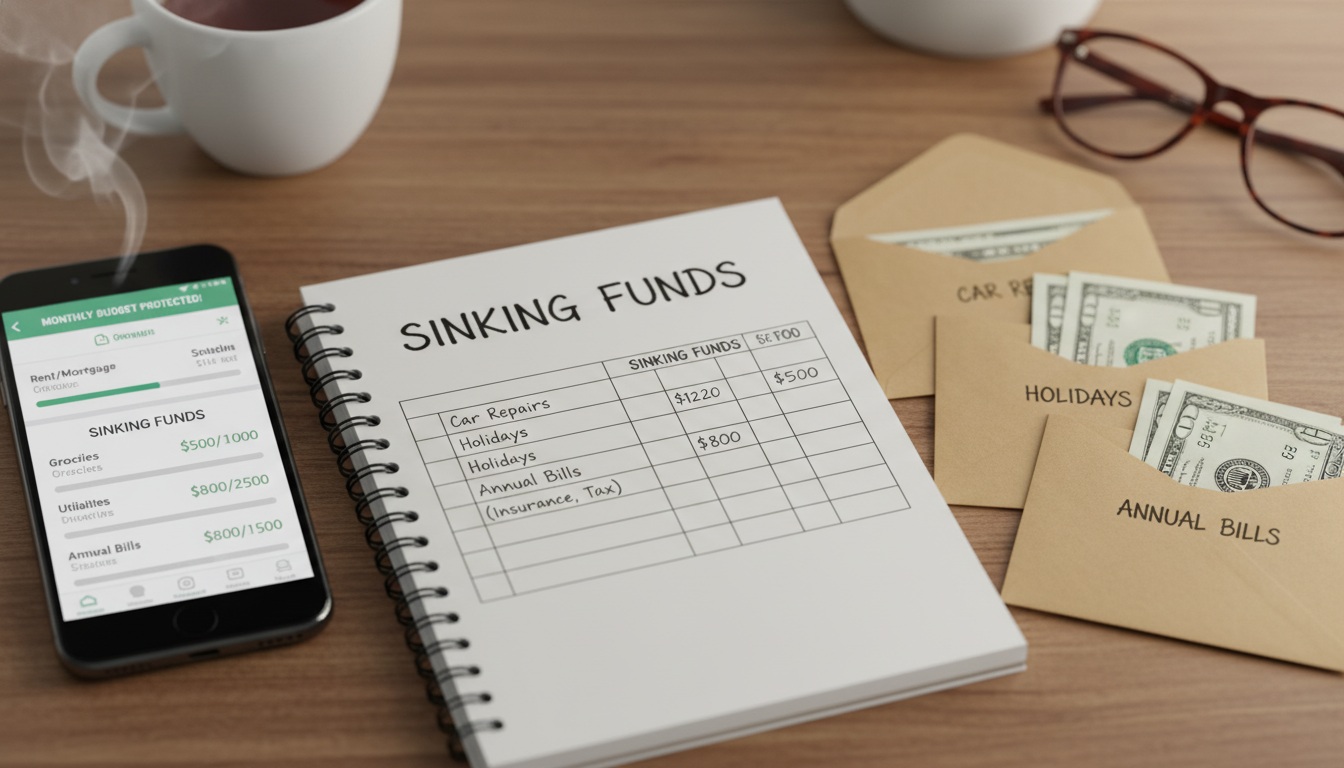

3. Set Aside 25-30% of Profits for Taxes

This is the mistake that catches most new side hustlers. Your side hustle income isn’t taxed automatically like your paycheck—you’re responsible for paying taxes quarterly.

Simple system:

- Open a separate savings account

- Transfer 25-30% of every payment immediately

- Pay estimated quarterly taxes (IRS Form 1040-ES)

- Work with a tax professional your first year

Understanding your complete financial picture helps you make smarter decisions about investing in your side hustle.

Common Side Hustle Mistakes to Avoid After 40

Learn from others’ mistakes so you don’t have to make them yourself.

Perfectionism Paralysis

The mistake: Spending months building the “perfect” website, logo, or product before launching.

The reality: Your first version will be imperfect, and that’s fine. Launch with “good enough” and improve based on real customer feedback.

The fix: Give yourself a 30-day deadline to launch something—anything. Imperfect action beats perfect inaction every time.

Underpricing Your Expertise

The mistake: Charging $25/hour because you’re “just starting out.”

The reality: You have 20+ years of experience. Your knowledge is valuable. Underpricing attracts difficult clients and makes profitability impossible.

The fix: Research market rates, then price in the middle to upper range. You can always lower prices; raising them is harder.

Trying to Do Everything

The mistake: Starting a blog, YouTube channel, podcast, and Etsy shop simultaneously.

The reality: You’ll burn out in weeks and accomplish nothing.

The fix: Choose ONE platform and ONE offering. Master it, make it profitable, then consider expanding.

Ignoring Stress Management

The mistake: Pushing yourself to exhaustion, sacrificing sleep and health to build your side hustle.

The reality: You’re not 25 anymore. Your body and mind need rest to perform optimally.

The fix: Build your side hustle schedule around your energy patterns, not against them. Protect your sleep, exercise, and recovery time.

See: Stress-Proofing Your Life: A Mid-Life Man’s Guide

Not Validating Demand

The mistake: Building a product or service you think people need without asking them first.

The reality: What you think is valuable and what people will pay for are often different.

The fix: Before investing significant time or money, talk to 10-20 potential customers. Ask what they struggle with and what they’d pay to solve it.

Neglecting the Mental Game

Starting a side hustle after 40 requires building mental toughness and overcoming decades of conditioning that says “stay safe” and “don’t risk it.”

Mindset: The New Psychology of Success

How to Know If Your Side Hustle Is Working

Set realistic expectations and measurable milestones.

Success Benchmarks by Timeline

Month 1: Validation

- First paying customer or sale

- 5-10 meaningful conversations with potential customers

- Basic systems in place (payment, communication, delivery)

Month 3: Traction

- Consistent $100-300 monthly revenue

- 3-5 regular or repeat customers

- Clear understanding of what’s working and what’s not

Month 6: Growth

- $500-1,000 monthly revenue

- Streamlined processes that save you time

- Positive customer feedback and referrals

Month 12: Sustainability

- $1,500-3,000 monthly revenue

- Decision point: scale up, maintain, or pivot

- Systems that run with minimal daily intervention

Reality check: These numbers are realistic for someone working 5-10 hours weekly. If you’re investing more time or have unique advantages, you might progress faster. If you’re starting completely from scratch in a new field, it might take longer.

Key Metrics to Track

Don’t just track revenue—track these indicators of long-term success:

Customer Acquisition Cost

How much time and money does it take to get one customer? Lower is better.

Customer Lifetime Value

How much does an average customer spend with you over time? Higher is better.

Time to Revenue

How many hours of work does it take to generate $100? Track this monthly to see if you’re getting more efficient.

Referral Rate

What percentage of customers refer others? Above 20% means you’re doing something right.

Your Satisfaction Level

Rate your enjoyment weekly (1-10). If you’re consistently below 6, something needs to change.

Final Thoughts

Remember, starting a side hustle after 40 isn’t about getting rich quick – it’s about creating sustainable, long-term wealth that works around your existing life. Start small, stay consistent, and keep learning as you go.

Your 40s and 50s offer advantages younger entrepreneurs simply don’t have. You’ve got experience, judgment, networks, and resources. What you’re building now isn’t just extra income—it’s security, freedom, and proof that it’s never too late to create something meaningful.

“Don’t wait for the perfect moment. Take the moment and make it perfect.”

— Zoey Sayward

The men who succeed at starting a side hustle after 40 aren’t the ones with the most time, money, or advantages. They’re the ones who start, stay consistent, and adjust based on real feedback. That can be you.

Action Steps for This Week

- Identify your top skill: Spend 30 minutes listing what you’re genuinely good at

- Research demand: Check Upwork, Fiverr, or Etsy for similar services/products

- Create one simple offer: Write one paragraph describing what you’ll provide and for whom

- Tell 10 people: Email, text, or call 10 contacts about your new offering

- Set up basic infrastructure: Create a PayPal account and simple way to schedule/deliver

Want weekly strategies for building wealth, health, and mindset after 40? Start with small, consistent actions that compound over time.

What side hustle idea resonates most with you? The best time to start was 20 years ago. The second-best time is right now.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Important Note: The information provided in this article is for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making significant financial decisions. Your situation is unique, and these general guidelines may need to be adjusted to your specific circumstances.