Passive Income Streams: A Realistic Approach for Your 40s

If you’re in your 40s and feeling like you’ve missed the boat on building wealth, take a deep breath. You’re not alone, and here’s the truth: you’re actually in one of the best positions to start creating income that works for you, even while you sleep.

“The best time to plant a tree was 20 years ago. The second best time is now.”

– Chinese Proverb

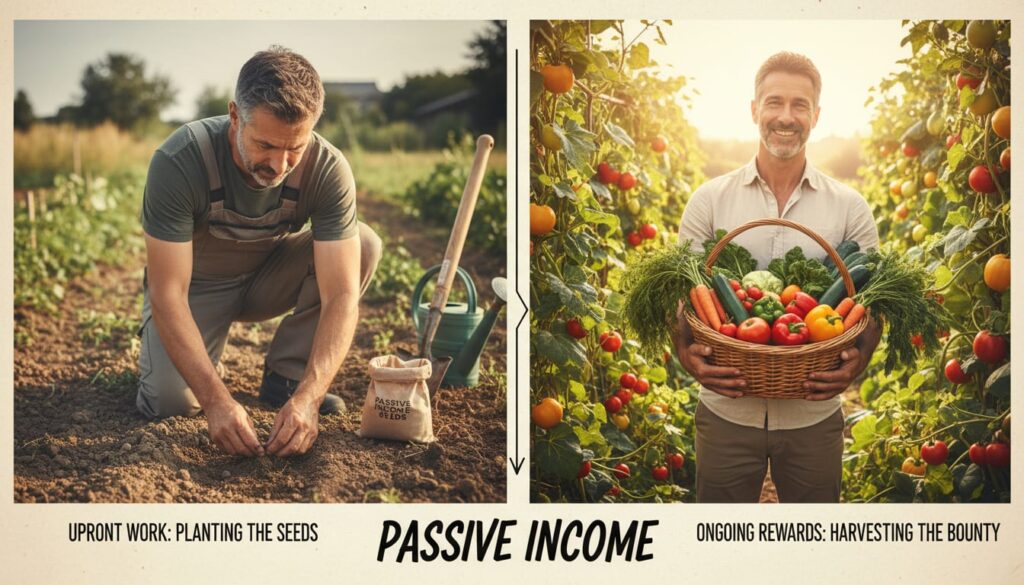

Let’s be real—you’ve probably heard about “passive income” before. Maybe you’ve rolled your eyes at those “make money while you sleep” promises that sound like scams. You’re right to be skeptical. Real passive income isn’t magic—it requires upfront work, smart planning, and realistic expectations. But here’s what makes it worth your time: when done right, these strategies can provide the financial breathing room and security you’re looking for, without requiring you to quit your job or neglect your family.

The key is balancing your physical health, mental clarity, and financial goals—because building passive income in your 40s isn’t just about money. It’s about creating the life you want while you still have the energy and time to enjoy it.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

What Are Passive Income Streams Really?

Before we dive in, let’s clear up what passive income actually means. It’s not about getting rich quick or making money without any effort. Passive income is money you earn with minimal ongoing effort after you’ve done the initial work to set it up.

Think of it like planting a garden—you put in the work upfront (planting, watering, fertilizing), and then you enjoy the harvest for years to come. The tomatoes keep growing without you standing there watching them every day.

For those of us in our 40s, realistic passive income strategies need to fit into our already busy lives. We’re juggling careers, families, mortgages, and maybe even caring for aging parents. We don’t have time for get-rich-quick schemes, but we do need strategies that can work alongside our existing responsibilities.

Here’s what makes your 40s the perfect time to start:

- You have more income than you did in your 20s or 30s

- You have life experience that helps you avoid scams and make smarter decisions

- You have discipline that comes from years of showing up and doing hard things

- You still have 20-30 years before retirement to let your money grow

Why Passive Income Matters Now More Than Ever

Let’s talk about why this matters right now. If you’re in your 40s, you’ve probably noticed:

- Your paycheck doesn’t stretch as far as it used to (thanks, inflation)

- Retirement feels both far away and way too close at the same time

- You’re tired of trading time for money and want more flexibility

- You worry about job security in an unpredictable economy

Building passive income streams for men over 40 isn’t about getting rich overnight. It’s about creating financial breathing room so you can:

- Take that vacation without stressing about money

- Help your kids with college without going broke

- Retire on your terms, not when your body gives out

- Sleep better knowing you have multiple income sources

The good news? You don’t need to be wealthy to start. You just need to start.

Starting Points for Different Budgets

One of the biggest myths about passive income is that you need thousands of dollars to begin. That’s simply not true. Here’s how to start based on what you can actually afford:

If You Have $50-100/Month

You’re not too small to start. Here’s your game plan:

- Open a high-yield savings account (Ally Bank, Marcus by Goldman Sachs, or similar) earning 4-5% interest

- Start with a free brokerage account (Fidelity, Schwab, or Robinhood)

- Buy fractional shares of dividend ETFs (you can invest $50 and own a piece of multiple companies)

- Example: $75/month into SCHD (a dividend ETF) = $900/year invested, potentially earning $30-40 in dividends your first year

Real talk: That $30-40 doesn’t sound like much, but it’s $30-40 you didn’t have before. And next year, if you keep investing that $75/month, you’ll earn even more. That’s compound interest at work.

If You Have $200-500/Month

You’re in the sweet spot. Here’s what to do:

- Split your money: 60% dividend stocks, 40% REITs (we’ll explain these below)

- Automate everything through your brokerage so you don’t have to think about it

- Example: $300/month = $3,600/year invested, potentially earning $180-250 in annual dividends by year 3

Why this works: You’re building momentum. By year 5, you could be earning $500-700/year in passive income. By year 10, that could be $2,000-3,000/year—enough for a nice vacation or to cover your car payment.

If You Have $500-1,000+/Month

You can build serious wealth. Here’s your strategy:

- Diversified portfolio: 50% index funds, 30% dividend stocks, 20% REITs

- Consider maxing out a Roth IRA ($7,000/year if you’re over 50)

- Open a taxable brokerage account for additional investments

- Example: $750/month = $9,000/year, building toward $500-800/month in passive income within 10-15 years

The math: If you invest $750/month for 15 years with a 7% average return, you’ll have approximately $240,000. At a 4% withdrawal rate, that’s $9,600/year or $800/month in passive income—without touching your principal.

Bottom line: You don’t need to be wealthy to start. Sarah from our example later in this article started with just $200/month while making $75,000/year. The key isn’t how much you start with—it’s that you start and stay consistent.

Related Articles

Investment Options Evaluation: Finding What Fits Your Life

When it comes to building passive income in your 40s, you need strategies that actually work with your busy schedule. Let’s break down the best options, what they really mean in plain English, and how much time and money each requires.

1. Dividend-Paying Stocks and Index Funds

What it is (in plain English):

Think of dividends like getting a paycheck from a company just for owning a piece of it. If you own shares in a company like Coca-Cola or Johnson & Johnson, they send you money regularly—usually every three months—as a “thank you” for being an investor.

An index fund is like buying a tiny piece of hundreds of companies all at once. Instead of picking individual stocks (which is risky), you’re spreading your money across the entire market. It’s the “don’t put all your eggs in one basket” approach to investing.

Why it works for 40-somethings:

You can start with whatever amount you have, and many brokerages offer commission-free trading. Plus, you don’t need to be a stock market expert—index funds do the heavy lifting for you.

Time commitment: 2-3 hours monthly for research and portfolio review

Risk level: Medium (individual stocks) to Low-Medium (diversified index funds)

Getting started:

- Open a brokerage account (Fidelity, Vanguard, or Schwab are solid choices)

- Start with a dividend-focused ETF like SCHD or VYM (these own dozens of dividend-paying companies)

- Set up automatic monthly investments—this is called “dollar-cost averaging” (fancy term for investing the same amount regularly, whether the market is up or down)

- Reinvest your dividends automatically to buy more shares

The Intelligent Investor Rev Ed.: The Definitive Book on Value Investing

2. Real Estate Investment Trusts (REITs)

What it is (in plain English):

REITs are like owning rental properties without the headaches. Instead of buying an apartment building yourself, you buy shares in a company that owns dozens of buildings. They collect rent, pay the bills, and send you a portion of the profits. You get real estate income without fixing toilets or dealing with tenants at 2 AM.

Why it works:

You get real estate exposure (historically one of the best wealth builders) without needing $100,000 for a down payment or becoming a landlord. REITs typically pay higher dividends than regular stocks—often 3-6% annually.

Time commitment: 1-2 hours monthly for monitoring

Risk level: Medium

Getting started:

- Research different types of REITs (residential apartments, office buildings, shopping centers, healthcare facilities)

- Start with a REIT ETF like VNQ or SCHH for instant diversification

- Allocate 10-20% of your investment portfolio to REITs

- Reinvest dividends or use them as income

Real example: If you invest $5,000 in a REIT paying 5% annually, that’s $250/year or about $21/month. Not life-changing yet, but combine this with other strategies and it adds up.

3. High-Yield Savings Accounts and CDs

What it is (in plain English):

These are bank accounts that pay you significantly more interest than traditional savings accounts. While your regular bank might pay you 0.01% interest (basically nothing), high-yield accounts pay 4-5%.

A CD (Certificate of Deposit) is when you agree to leave your money in the bank for a set period (6 months, 1 year, 5 years) in exchange for a guaranteed interest rate—usually higher than a savings account.

Why it works:

Zero risk to your principal (your original money), and rates have improved significantly in recent years. This is perfect for your emergency fund or money you’ll need in the next 1-3 years.

Time commitment: 30 minutes initially, then minimal ongoing effort

Risk level: Very Low (FDIC insured up to $250,000)

Getting started:

- Research online banks (Ally, Marcus, Discover, CIT Bank)

- Open an account online (takes 10-15 minutes)

- Set up automatic transfers from your checking account

- Watch your money grow without doing anything

Real numbers: $10,000 in a high-yield savings account at 4.5% = $450/year or $37.50/month. That’s a free dinner out every month just for parking your money somewhere smarter.

The Personal Finance QuickStart Guide

Grab The Personal Finance QuickStart Guide to understand where your money is going and how to optimize your savings strategy.

4. Peer-to-Peer Lending

What it is (in plain English):

Platforms like Prosper or LendingClub let you lend money directly to individuals or small businesses in exchange for interest payments. You’re basically becoming the bank—they borrow your money and pay you back with interest over time.

Why it works:

Potentially higher returns than traditional savings (5-9% annually), with the ability to start small and spread your money across many loans to reduce risk.

Time commitment: 2-4 hours monthly for loan selection and monitoring

Risk level: Medium to High (borrowers can default)

Getting started:

- Choose a reputable platform (Prosper, LendingClub, Funding Circle)

- Start with $1,000-2,500 spread across 40-100 loans ($25-50 per loan)

- Focus on higher-grade loans (A and B ratings) for lower risk

- Reinvest payments to compound your returns

Reality check: This isn’t as passive as other options because you need to monitor defaults and reinvest payments. But if you’re comfortable with moderate risk, it can boost your overall returns.

Time vs. Money Analysis: Making Smart Trade-offs

One of the biggest challenges in your 40s is balancing time and money. You might have more earning power than you did in your 20s or 30s, but you definitely have less free time.

This is where managing your energy and time effectively becomes crucial. Here’s how to think about this trade-off:

High Time Investment, Lower Money Requirement

Examples:

- Creating digital products (ebooks, courses)

- Building a blog or YouTube channel

- Freelancing that transitions to passive income

Best for: People with more time than money, or those who enjoy creating content

Reality: These take 6-12 months of consistent work before seeing meaningful income

Low Time Investment, Higher Money Requirement

Examples:

- Dividend stocks and index funds

- REITs

- High-yield savings accounts

Best for: Busy professionals with decent income but limited free time

Reality: You need capital to start, but once set up, they require minimal ongoing effort

The Perfect Balance: Moderate Time, Moderate Money

This is the sweet spot for most men in their 40s. Focus on strategies that require moderate money and moderate time, such as:

- Dividend growth investing (2-3 hours/month, $200-500/month investment)

- REIT ETFs (1 hour/month, $100-300/month investment)

- Automated index fund investing (30 minutes/month, $300-1,000/month investment)

The key is finding a weekly planning system that helps you stay consistent without overwhelming your already busy schedule.

Risk Assessment Strategies: Protecting What You’ve Built

In your 40s, you can’t risk losing what you’ve already built. But you also can’t play it so safe that inflation slowly steals your money’s value. You need a middle path.

Here’s how to assess and manage risk while building passive income:

The Risk Pyramid Approach

Think of your investments like a pyramid—stable foundation at the bottom, smaller risks at the top.

Foundation (60-70% of investments): Low-Risk, Stable Investments

- High-yield savings accounts

- Treasury bonds

- Blue-chip dividend stocks (companies like Procter & Gamble, Johnson & Johnson)

- Broad market index funds (S&P 500)

Growth Layer (20-30% of investments): Medium-Risk Investments

- Individual dividend stocks

- REIT ETFs

- Corporate bonds

- Growth-focused index funds

Opportunity Layer (5-10% of investments): Higher-Risk, Higher-Reward

- Individual REITs

- Peer-to-peer lending

- Small-cap stocks

- Emerging market funds

Example allocation for someone with $50,000 to invest:

- $35,000 (70%) in low-risk: $20,000 in S&P 500 index fund, $15,000 in high-yield savings

- $12,500 (25%) in medium-risk: $7,500 in dividend stocks, $5,000 in REIT ETF

- $2,500 (5%) in higher-risk: $2,500 in peer-to-peer lending

Risk Assessment Questions to Ask Yourself

Before making any investment, ask:

- Can I afford to lose this money? If losing it would hurt your family’s security, don’t invest it.

- How long can I leave this money invested? The stock market can be volatile short-term but historically grows long-term. You need at least 5-10 years.

- Do I understand this investment? If you can’t explain it to a friend, you don’t understand it well enough to invest.

- Am I emotionally prepared for ups and downs? Markets drop 10-20% regularly. Can you handle seeing your account balance drop without panicking?

- Is this diversified enough? Never put more than 5-10% of your portfolio in any single stock or investment.

This approach is all about building confidence through small, consistent wins—not gambling on get-rich-quick schemes.

A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy

Implementation Roadmap: Your 90-Day Action Plan

Let’s get practical. Here’s exactly what to do over the next 90 days to start building realistic passive income streams in your 40s.

Your First 30 Days: Building Your Financial Foundation

Week 1: Assessment and Goal Setting

- Calculate your current monthly income and expenses

- Identify how much you can realistically invest each month ($50? $200? $500?)

- Set a specific goal: “I want to generate $500/month in passive income within 10 years”

- Write it down and put it somewhere you’ll see it daily

Week 2: Emergency Fund

- Before investing, save 3-6 months of expenses in a high-yield savings account

- This protects you from having to sell investments during emergencies

- If you don’t have this yet, split your monthly amount: 50% to emergency fund, 50% to investments

Week 3: Account Setup

- Open a brokerage account (Fidelity, Vanguard, or Schwab)

- Open a high-yield savings account (Ally, Marcus, or Discover)

- Link your checking account for automatic transfers

- Set up automatic investments (even if it’s just $50/month to start)

Week 4: Education

- Read The Bogleheads’ Guide to Investing—this is THE book for passive income investing

- Join the Bogleheads forum or Reddit’s r/financialindependence community

- Watch YouTube channels like “The Plain Bagel” or “Two Cents” for visual learners

Days 31-60: Initial Investments

Week 5-6: Start Simple

- Make your first investment: Put 100% into a broad market index fund (VTSAX, FSKAX, or similar)

- Don’t overthink it—the goal is to START, not to be perfect

- Set up automatic monthly investments

- Resist the urge to check your account daily (check monthly at most)

Week 7-8: Add Dividend Focus

- Add a dividend-focused ETF (SCHD, VYM, or DGRO)

- Adjust your allocation: 70% broad market index, 30% dividend ETF

- Set dividends to automatically reinvest

- This is called compound interest—money making money. If you invest $1,000 and earn 7% ($70), next year you earn 7% on $1,070 instead of just your original $1,000. It’s like a snowball rolling downhill—it gets bigger as it goes.

Days 61-90: Expansion and Optimization

Week 9-10: Individual Stock Research

- If you want to add individual dividend stocks, research “Dividend Aristocrats” (companies that have increased dividends for 25+ consecutive years)

- Examples: Coca-Cola, Johnson & Johnson, Procter & Gamble, 3M

- Start with 1-2 stocks maximum, investing no more than 5% of your portfolio in each

- Focus on companies you understand and use in daily life

Week 11-12: Review and Adjust

- Review your first 90 days: What worked? What didn’t?

- Calculate your progress: How much have you invested? What’s your current passive income?

- Adjust your monthly investment amount if needed

- Celebrate small wins—you’re building something that will compound for decades

This 30-day approach to building new financial habits can be repeated quarterly to continuously improve your passive income strategy.

The Financial Planning Workbook: A Comprehensive Guide to Building a Successful Financial Plan (2025 Edition)

Common Mistakes to Avoid

Let’s talk about the mistakes that can derail your passive income journey. I’ve seen these trip up countless men in their 40s, and they’re all avoidable.

1. Chasing High Yields

Just because an investment promises 15% returns doesn’t mean it’s good. Often, extremely high yields are a red flag for high risk or unsustainable business models.

Example: A stock paying a 12% dividend might be cutting essential business expenses to maintain that payout. When the company struggles, they’ll cut the dividend and the stock price will crash. You lose twice.

Better approach: Focus on sustainable yields of 2-5% with a history of dividend growth.

2. Not Diversifying

Don’t put all your money in one type of investment, no matter how good it seems. Spread your risk across different asset classes and sectors.

Bad example: Investing $10,000 entirely in one REIT because it pays 8% dividends

Better example: $4,000 in S&P 500 index fund, $3,000 in dividend stocks, $2,000 in REIT ETF, $1,000 in high-yield savings

Why it matters: If one sector crashes (like real estate in 2008), you don’t lose everything.

3. Trying to Time the Market

You can’t predict when the market will go up or down. Instead, invest consistently over time through dollar-cost averaging (remember: investing the same amount regularly, whether the market is up or down).

Reality check: Studies show that even professional investors can’t consistently time the market. Your best strategy is to invest regularly and ignore the noise.

This is where avoiding emotional money decisions becomes critical to long-term success.

4. Ignoring Fees

High fees can eat away at your returns over time. A 1% fee might not sound like much, but over 20 years, it can cost you tens of thousands of dollars.

Example:

- Investment A: $100,000 growing at 7% with 0.1% fees = $361,000 after 20 years

- Investment B: $100,000 growing at 7% with 1% fees = $320,000 after 20 years

- Difference: $41,000 lost to fees

Solution: Look for low-cost index funds and ETFs (Vanguard, Fidelity, Schwab typically have the lowest fees).

5. Getting Emotional

Don’t panic sell when the market drops or get greedy when it’s rising. Stick to your plan and think long-term.

Real scenario: In March 2020, the market dropped 30% due to COVID-19. People who panic-sold locked in massive losses. People who stayed invested (or bought more) saw their portfolios recover and reach new highs within 18 months.

Your mantra: “I’m investing for 10-20 years, not 10-20 days.”

Tools and Resources for Success

Here are the specific tools and resources that will make your passive income journey easier:

Investment Platforms

- Fidelity: No account minimums, excellent research tools, great customer service

- Vanguard: Pioneer of low-cost index funds, perfect for buy-and-hold investors

- Schwab: Strong all-around platform with excellent checking account integration

- M1 Finance: Great for automated “pie” investing (set your allocation and forget it)

Educational Resources

- The Bogleheads’ Guide to Investing – The definitive guide to passive income investing

- The Intelligent Investor by Benjamin Graham – Learn to think like a value investor

- A Random Walk Down Wall Street – Understand market risk and diversification

- Morningstar.com – Free research on stocks, funds, and ETFs

- SEC.gov – Official filings and investor education

Portfolio Tracking

- Personal Capital (free) – Track all your accounts in one place

- Mint (free) – Budget tracking and investment monitoring

- Financial Planning Workbook – Physical tracking for those who prefer pen and paper

Community Support

- Bogleheads Forum – Incredibly helpful community of passive investors

- Reddit r/financialindependence – Real stories and strategies from people building passive income

- Reddit r/dividends – Focused specifically on dividend investing

The Bogleheads' Guide to Investing

What makes this book especially valuable for our audience is its straightforward approach to complex topics like backdoor Roth IRAs, ETF investing, and retirement planning, all explained in plain English with real-world examples. The authors show you how to create a diversified portfolio that works while you focus on your career and family, proving that successful investing doesn't require hours of daily research or risky stock picking. If you're ready to stop overthinking your investments and start building lasting wealth with a strategy that's worked for thousands of everyday investors, this book will give you the confidence and knowledge to take control of your financial future.

Making It Work with Your Busy Life

Let’s be realistic—you’re busy. Between work, family, and everything else, you might feel like you don’t have time to manage investments. Here are strategies to make passive income streams truly passive:

Automation is Your Friend

Set it and forget it:

- Automatic transfers from checking to investment accounts (same day each month)

- Automatic investments into your chosen funds (dollar-cost averaging)

- Automatic dividend reinvestment (DRIP) so your dividends buy more shares

- Automatic rebalancing (many platforms offer this quarterly or annually)

Real example: Set up $300 to automatically transfer on the 1st of each month, automatically invest in your chosen allocation (70% index fund, 30% dividend ETF), and automatically reinvest dividends. Total time required after setup: 0 minutes per month.

Start Small and Scale

You don’t need to have everything figured out on day one:

- Month 1-3: Invest in one simple index fund

- Month 4-6: Add a dividend ETF

- Month 7-12: Consider adding individual dividend stocks or REITs

- Year 2+: Optimize and refine based on what you’ve learned

Why this works: You build confidence and knowledge gradually instead of getting overwhelmed and quitting.

Keep It Simple

The best investment strategy is one you’ll actually stick with:

- 3-fund portfolio: Total stock market index + international index + bond index

- 2-fund portfolio: S&P 500 index + dividend ETF

- 1-fund portfolio: Target-date retirement fund (automatically adjusts as you age)

Truth bomb: A simple strategy you follow for 20 years will beat a complex strategy you abandon after 2 years.

This is all about integrating financial planning with your overall life strategy—not letting it consume your life.

Real-World Example: Sarah’s Journey

Let me share a story about Sarah, a 42-year-old marketing manager who started her passive income journey two years ago. She was making $75,000 per year but felt like she was living paycheck to paycheck despite her decent salary.

Sarah’s Starting Point

- Age: 42

- Income: $75,000/year

- Savings: $5,000 in a regular savings account (earning basically nothing)

- Debt: $8,000 in credit card debt

- Retirement: $45,000 in 401(k) (not enough for her age)

- Monthly budget available: $200 after expenses

Her 24-Month Plan

Months 1-6: Foundation

- Paid off credit card debt using the avalanche method (highest interest first)

- Moved $5,000 to high-yield savings account earning 4.5%

- Started investing $100/month in SCHD (dividend ETF)

Months 7-12: Building Momentum

- Increased investment to $200/month

- Split allocation: $140 to SCHD, $60 to VNQ (REIT ETF)

- Joined Bogleheads forum for support and education

- Read “The Bogleheads’ Guide to Investing”

Months 13-18: Expansion

- Got a raise to $82,000/year

- Increased investment to $350/month

- Added two individual dividend stocks: Johnson & Johnson and Procter & Gamble

- Set up automatic dividend reinvestment

Months 19-24: Optimization

- Increased investment to $400/month

- Refinanced her mortgage, saving $150/month

- Used savings to max out Roth IRA contribution

- Started tracking progress with a financial planning workbook

Sarah’s Results After 24 Months

- Total invested: $6,200

- Account value: $7,100 (includes market growth)

- Annual passive income: $180 in dividends ($15/month)

- Emergency fund: $12,000 in high-yield savings (earning $540/year)

- Total passive income: $720/year ($60/month)

Sarah’s reflection: “It’s not life-changing money yet, but seeing that $60/month come in without me doing anything is incredibly motivating. I’m on track to hit $500/month in passive income within 8 more years. That will cover my car payment, insurance, and gas—essentially making my transportation free.”

The lesson: Sarah didn’t start with a lot. She didn’t have everything figured out. She just started, stayed consistent, and adjusted as she learned. That’s exactly what you can do.

Frequently Asked Questions About Passive Income in Your 40s

Your Next Steps

Here’s exactly what to do this week, this month, and this quarter to start building passive income in your 40s.

This Week

- Calculate your available investment amount (even if it’s just $50/month)

- Open a high-yield savings account and move your emergency fund there

- Choose one brokerage (Fidelity, Vanguard, or Schwab) and start the account opening process

- Order The Bogleheads’ Guide to Investing and start reading

This Month

- Make your first investment (even if it’s just $50 into an S&P 500 index fund)

- Set up automatic monthly transfers from checking to investment account

- Set up automatic investments so your money goes to work immediately

- Join the Bogleheads forum or r/financialindependence subreddit for community support

This Quarter

- Establish your investment routine (monthly check-ins, quarterly rebalancing)

- Add a second investment (dividend ETF or REIT if you started with index fund)

- Track your progress using Personal Capital or a financial planning workbook

- Increase your investment amount by 10-20% if possible

Remember, the goal isn’t perfection—it’s progress. Every dollar you invest today is a dollar that can start working for you immediately. The compound interest effect means that starting now, even with small amounts, can lead to significant wealth over time.

Implement a weekly financial check-in routine to stay on track without obsessing over daily market movements.

Final Thoughts

Creating passive income streams in your 40s requires a realistic approach that balances your current responsibilities with your future financial goals. You don’t need to become a full-time investor or risk your family’s financial security. You just need to start, stay consistent, and let time work in your favor.

The strategies we’ve covered—from dividend investing to REITs to high-yield savings—can all play a role in your financial independence journey. The key is choosing the mix that fits your risk tolerance, time availability, and financial goals.

Here’s the truth that nobody talks about: Building passive income is boring. It’s not exciting. It’s not glamorous. There are no shortcuts or secret strategies. It’s just consistent, disciplined investing over many years.

But boring works. Boring builds wealth. Boring lets you sleep at night knowing you’re building something real for your future.

“Do not save what is left after spending, but spend what is left after saving.”

– Warren Buffett

You’re in your 40s. You’ve spent two decades building your career, your family, and your life. Now it’s time to build income streams that will support all of that—income that works for you instead of you working for it.

Don’t let another year pass wishing you had started. Your future self—the one enjoying financial freedom in 10 years—is counting on the decision you make today.

Your next move: Choose one strategy from this article and take action this week. Open that brokerage account. Set up that automatic transfer. Order that first book. The best time to start was 20 years ago. The second best time is right now.

Ready to dive deeper? This article is part of our comprehensive guide to building wealth in your 40s. For more practical financial advice tailored to busy professionals, check out:

- The Mid-Life Wealth Building Blueprint

- Financial Foundation Reset: Your Mid-Life Money Checklist

- Learn more about Financial Independence strategies

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Important Note: The information provided in this article is for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making significant financial decisions. Your situation is unique, and these general guidelines may need to be adjusted to your specific circumstances.