Strategic Debt Elimination Approaches: Your Path to Financial Freedom After 40

You’re not alone if you’re carrying debt into your 40s and beyond. Whether it’s credit cards, student loans, a mortgage, or a mix of everything, debt can feel like an anchor holding you back from the life you want. The good news? It’s absolutely possible to break free—and you might have more control over the situation than you think.

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make.”

– Dave Ramsey

This post walks you through practical, straightforward strategies to eliminate debt without needing a finance degree or a six-figure income. We’ll keep things simple, real, and focused on what actually works for men in your position.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Understanding Your Debt Situation

Before you can tackle debt, you need to know what you’re dealing with. Think of it like fitness—you wouldn’t start a workout plan without knowing your current fitness level, right?

What counts as debt? Debt is money you owe to someone else. The most common types are:

- Credit card debt: Money you’ve borrowed and need to pay back with interest (the extra cost of borrowing). Interest rates on credit cards are typically high—often 15-25% annually.

- Student loans: Money borrowed to pay for education, usually with lower interest rates than credit cards.

- Mortgage: Money borrowed to buy a home, typically the largest debt most people carry.

- Personal loans: Money borrowed for various purposes, often with moderate interest rates.

- Auto loans: Money borrowed to buy a vehicle.

The key thing to understand is that debt comes with interest—extra money you pay just for borrowing. The higher the interest rate, the more you’re paying beyond what you actually borrowed.

Why this matters: If you’re only making minimum payments, you’re mostly paying interest, not actually reducing what you owe. It’s like running on a treadmill—you’re working hard but not getting anywhere.

Start by listing all your debts: what you owe, to whom, the interest rate, and the monthly payment. This simple act gives you clarity and control.

The Power of Strategic Approaches

Getting out of debt isn’t about willpower alone—it’s about having a strategy. A strategy is simply a plan that works with your situation, not against it. Think of it as the difference between randomly hitting the gym versus following a structured workout program. One gets results; the other just exhausts you.

Here are the main strategic approaches that actually work:

The Avalanche Method: Attack High-Interest Debt First

The avalanche method means paying the minimum on all debts, then putting any extra money toward the debt with the highest interest rate first. This is mathematically the fastest way to get out of debt because you’re stopping the most expensive borrowing first.

Example: Let’s say you have:

- Credit card A: $5,000 at 22% interest

- Credit card B: $3,000 at 18% interest

- Student loan: $15,000 at 5% interest

With the avalanche method, you’d pay minimums on everything but throw extra money at Credit Card A first (the highest rate). Once it’s paid off, you move to Credit Card B, then the student loan.

Who this works best for: People who are motivated by math and efficiency. If you like knowing you’re making the smartest financial move, this approach keeps you focused.

The Snowball Method: Build Momentum with Quick Wins

The snowball method is different. You pay minimums on everything, then attack the smallest debt first, regardless of interest rate. Once that’s paid off, you roll that payment into the next smallest debt, creating a “snowball” of momentum.

Example: Using the same debts above, you’d attack the $3,000 credit card B first, then the $5,000 credit card A, then the student loan.

Why it works: Paying off a debt completely—even a small one—feels amazing. That psychological win keeps you motivated. You see progress quickly, which matters more than you might think when you’re trying to stay committed for months or years.

Who this works best for: People who need motivation and quick wins. If you get discouraged easily, seeing debts disappear completely keeps you going.

Not sure which method works for you? Check out our article, Debt Snowball vs Avalanche: Which Is Right for You?

Balance Transfer Strategy: Lower Your Interest Rate

A balance transfer means moving debt from one credit card (usually with high interest) to another card offering a promotional rate—often 0% for 6-21 months. This gives you breathing room to pay down the actual debt without interest piling up.

Example: You have $8,000 on a card charging 20% interest. You transfer it to a new card with 0% for 12 months. For that year, every dollar you pay goes directly to reducing what you owe, not paying interest.

The catch: There’s usually a transfer fee (2-5% of the amount transferred), and after the promotional period ends, the interest rate jumps back up. You need a solid plan to pay down the debt during that interest-free window.

Who this works best for: People with decent credit who can qualify for promotional cards and have the discipline to pay aggressively during the 0% period.

Debt Consolidation: Simplify Multiple Debts

Consolidation means combining multiple debts into one loan, usually with a lower interest rate. Instead of juggling five different payments, you make one payment.

Example: You have three credit cards totaling $12,000 with rates around 18-22%. You take out a personal loan for $12,000 at 10% interest. Now you have one payment instead of three, and you’re paying less interest overall.

The benefit: Simplicity. One payment, one interest rate, one deadline. This reduces stress and makes it easier to stay on track.

Who this works best for: People who feel overwhelmed by multiple debts and need to simplify their financial life.

Related Articles:

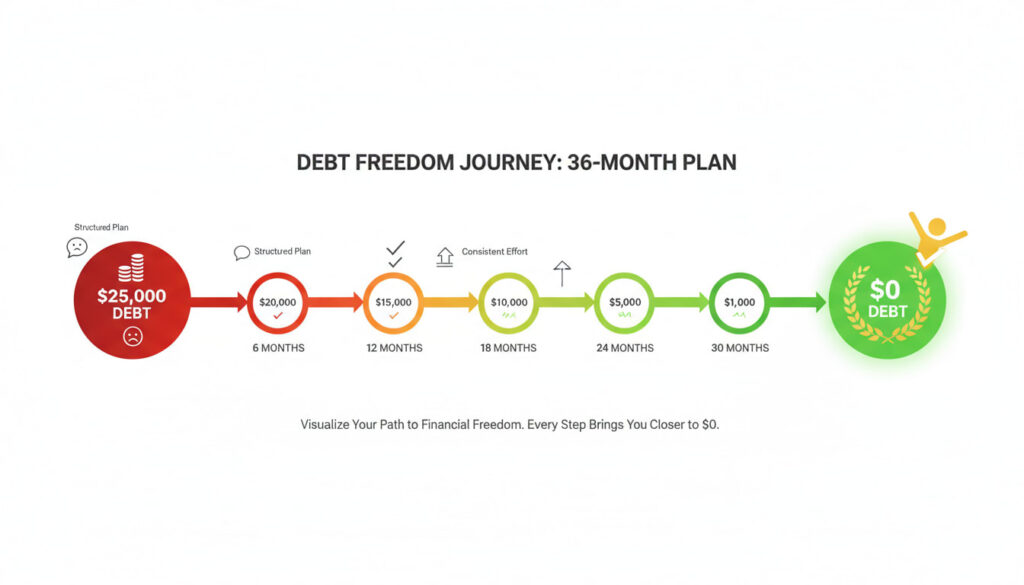

Creating Your Debt Elimination Timeline

Here’s where strategy becomes real: creating a timeline that works for your situation, not someone else’s.

Step 1: Calculate Your Current Situation

Write down:

- Total debt amount

- Total monthly payments you’re currently making

- How much extra money you could put toward debt each month (even $50 counts)

Example: Let’s say you have $25,000 in total debt, you’re paying $600/month currently, and you can find an extra $200/month by cutting back on subscriptions or dining out.

Step 2: Choose Your Method

Decide which approach resonates with you:

- Avalanche: If you want the mathematically fastest route

- Snowball: If you need quick wins and motivation

- Balance transfer: If you have good credit and high-interest cards

- Consolidation: If you need simplicity and lower rates

There’s no “wrong” choice. The best method is the one you’ll actually stick with.

Step 3: Build Your Timeline

Using a simple spreadsheet or even pen and paper, map out your payoff. Here’s a realistic example:

Scenario: $25,000 debt, $800/month total payment (current $600 + extra $200)

- Aggressive approach: 31-32 months (about 2.5 years)

- Moderate approach: 40-45 months (about 3.5 years)

- Sustainable approach: 50+ months (4+ years)

The aggressive approach gets you out faster but requires strict discipline. The sustainable approach is slower but more realistic for most people’s lives.

Step 4: Adjust for Your Income Level

Your timeline depends on your income and expenses. Here’s how different income levels might approach this:

Lower income ($30-50k/year): Focus on the snowball method for motivation. Even $100/month extra makes a difference. Look for ways to increase income (side gigs, raises) rather than aggressive cuts that hurt your quality of life.

Middle income ($50-100k/year): You have more flexibility. The avalanche method might work well, or a combination approach. You can likely find $200-300/month without major lifestyle changes.

Higher income ($100k+/year): You have options. Consider aggressive payoff timelines, but also think about whether paying off lower-interest debt (like a 3% mortgage) makes sense versus investing that money. Sometimes the math favors investing over paying off low-rate debt.

Key point: Your timeline should fit your life, not the other way around. A 4-year plan you stick with beats a 2-year plan you abandon after 6 months.

Practical Tools and Resources to Support Your Journey

You don’t need expensive software or complicated systems. Here are practical tools that actually help:

Budgeting and tracking: The YNAB (You Need A Budget) app is excellent for tracking where your money goes and finding extra cash for debt payoff. It costs about $15/month but pays for itself through the money you’ll find.

Debt payoff calculators: Free tools like Undebt.it let you input your debts and see exactly how long payoff will take with different strategies.

Accountability: Consider the The Total Money Makeover by Dave Ramsey if you need motivation and a structured approach. It’s practical and straightforward.

Spreadsheet template: Create a simple Google Sheet with columns for debt name, balance, interest rate, and minimum payment. Update it monthly—seeing the balance drop is incredibly motivating.

The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Grab a copy of The Total Money Makeover by Dave Ramsey on Amazon. It's the bible of debt elimination and breaks down these concepts with even more real-world examples. Dave is a huge advocate of the snowball method and has helped millions get out of debt.

Connecting Debt Elimination to Your Bigger Picture

Eliminating debt isn’t just about numbers—it’s about freedom. When you’re debt-free, you can finally focus on building wealth and creating the life you actually want.

Check out our guide on Creating Your Personal Success Ecosystem to see how debt elimination fits into your broader goals for physical wellness, mental resilience, and financial independence. And if you’re looking to build multiple income streams while paying off debt, our post on Creating Multiple Income Streams After 40 shows you how side income can accelerate your payoff timeline.

Your Next Steps

This week: List all your debts with balances, interest rates, and minimum payments.

Next week: Choose your strategy (avalanche, snowball, balance transfer, or consolidation) based on what resonates with you.

Within two weeks: Create your timeline and identify where you can find extra money each month.

Remember, getting out of debt is a marathon, not a sprint. Every dollar you put toward debt is a dollar moving you toward freedom. You’ve got this.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Important Note: The information provided in this article is for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making significant financial decisions. Your situation is unique, and these general guidelines may need to be adjusted to your specific circumstances.