The 50/30/20 Budget Reset: Financial Planning for Your Prime Years

If you’re in your 40s or 50s and feel like your finances are a bit of a mess, you’re not alone. Maybe you’ve been winging it for years, living paycheck to paycheck, or just never really had a solid plan. The good news? It’s never too late to hit the reset button and take control of your money.

“A journey of a thousand miles begins with a single step.”

— Chinese Proverb

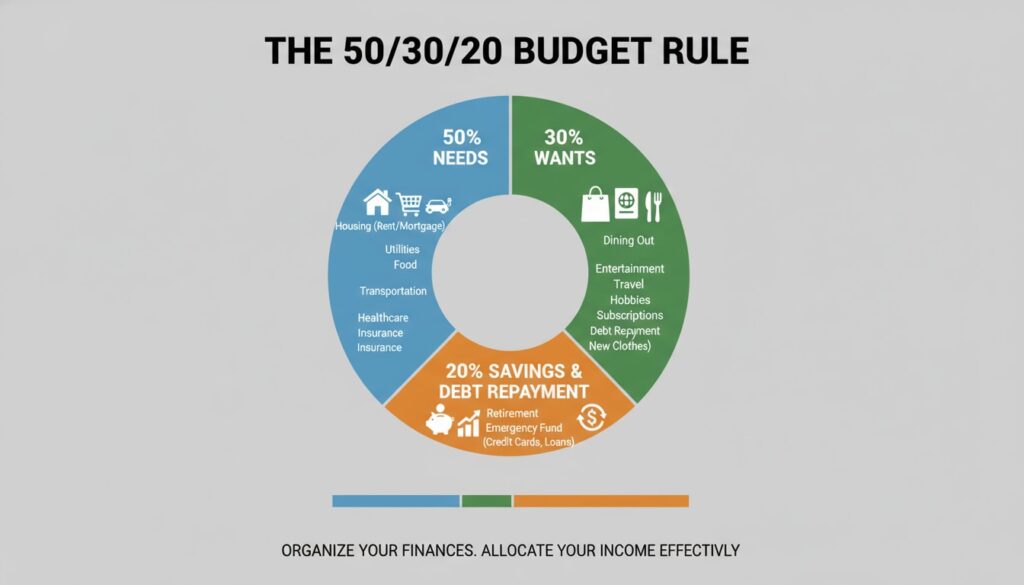

The 50/30/20 budget rule is one of the simplest, most effective ways to organize your finances without needing a degree in accounting or a fancy spreadsheet. It’s straightforward: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. That’s it.

In this guide, we’ll break down exactly how to implement this budget reset in your prime years, simplify the financial jargon, and give you actionable steps you can start today—no matter your income level or profession.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

What Is the 50/30/20 Budget Rule?

The 50/30/20 rule is a budgeting framework that divides your after-tax income (the money you actually take home after taxes are deducted) into three categories:

- 50% for Needs: Essential expenses you can’t avoid—rent or mortgage, utilities, groceries, insurance, minimum debt payments, transportation.

- 30% for Wants: Non-essential spending that makes life enjoyable—dining out, hobbies, entertainment, subscriptions, vacations.

- 20% for Savings and Debt Repayment: Building your financial future—emergency fund, retirement accounts, paying off credit cards or loans faster than the minimum.

Why This Works for Men Over 40

By your 40s and 50s, life gets complicated. You might have a mortgage, kids’ expenses, aging parents to support, or debt you’ve been carrying for years. The 50/30/20 rule gives you a simple structure that adapts to your life without requiring you to track every single dollar.

It’s flexible enough to work whether you’re earning $36,000 a year or $120,000. The percentages stay the same—only the dollar amounts change.

Breaking Down the Categories: Needs, Wants, and Savings

50% Needs: The Non-Negotiables

These are expenses you must pay to survive and function. If you lost your job tomorrow, these are the bills you’d still need to cover (at least temporarily).

Examples of Needs:

- Housing (rent, mortgage, property taxes, home insurance)

- Utilities (electricity, water, gas, internet)

- Groceries and basic household supplies

- Transportation (car payment, gas, insurance, public transit)

- Health insurance and necessary medications

- Minimum debt payments (credit cards, student loans, car loans)

- Childcare or dependent care

Income-Level Examples:

- $36,000/year ($3,000/month): $1,500 for needs

- $72,000/year ($6,000/month): $3,000 for needs

- $120,000/year ($10,000/month): $5,000 for needs

If your needs exceed 50%, don’t panic. We’ll cover how to adjust in the next section.

30% Wants: The Fun Stuff

Wants are things that improve your quality of life but aren’t essential for survival. This is where you get to enjoy your hard-earned money.

Examples of Wants:

- Dining out and takeout

- Entertainment (movies, concerts, sports events)

- Hobbies and recreational activities

- Gym memberships or fitness classes

- Streaming services (Netflix, Spotify, etc.)

- Vacations and travel

- New clothes beyond basics

- Upgraded phone or tech gadgets

Income-Level Examples:

- $36,000/year: $900/month for wants

- $72,000/year: $1,800/month for wants

- $120,000/year: $3,000/month for wants

The key here is intentionality. Spend on what truly brings you joy, not just out of habit or impulse.

20% Savings and Debt Repayment: Building Your Future

This is the category that transforms your financial life. It’s where you build security, reduce stress, and create freedom for your future self.

What Goes Here:

- Emergency fund: 3-6 months of expenses saved in a high-yield savings account (a savings account that pays you more interest than a regular one—think 4-5% instead of 0.01%). “The Total Money Makeover” by Dave Ramsey is a great resource for building emergency funds step-by-step.

- Retirement contributions: 401(k) (an employer-sponsored retirement account where you contribute pre-tax dollars), Roth IRA (a retirement account where you contribute after-tax dollars but withdraw tax-free in retirement), or other retirement accounts.

- Debt repayment beyond minimums: Extra payments on credit cards, student loans, car loans, or personal loans.

- Investment accounts: Brokerage accounts for index funds (a type of investment that tracks the overall stock market—think of it as buying a little piece of hundreds of companies at once instead of picking individual stocks).

Income-Level Examples:

- $36,000/year: $600/month for savings/debt

- $72,000/year: $1,200/month for savings/debt

- $120,000/year: $2,000/month for savings/debt

The Total Money Makeover

Grab a copy of The Total Money Makeover by Dave Ramsey on Amazon. It's the bible of debt elimination and breaks down these concepts with even more real-world examples. Dave is a huge advocate of the snowball method and has helped millions get out of debt.

Clever Fox Budget Planner - Expense Tracker Notebook

How to Implement Your 50/30/20 Budget Reset

Step 1: Calculate Your After-Tax Income

Start with your monthly take-home pay—the amount that actually hits your bank account after taxes, health insurance, and retirement contributions are deducted.

Example:

- Gross annual salary: $60,000

- After taxes and deductions: ~$48,000/year or $4,000/month

Use $4,000 as your baseline for the 50/30/20 split.

Step 2: Track Your Current Spending for 30 Days

Before you can reset, you need to know where your money is actually going. For one month, track every dollar you spend.

How to Track:

- Use a budgeting app (Mint, YNAB, EveryDollar)

- Keep receipts and log them in a notebook

- Review bank and credit card statements weekly

Categorize each expense as a Need, Want, or Savings/Debt payment. Be honest with yourself—that daily $6 latte is a want, not a need.

Budget Planner and Monthly Bill Organizer

Step 3: Adjust Your Spending to Fit the Framework

Once you see where your money goes, compare it to the 50/30/20 target.

Common Scenarios:

Scenario A: Your needs are 65% of income

- Look for ways to reduce fixed costs: refinance your mortgage, switch to a cheaper cell phone plan, carpool or use public transit, negotiate insurance rates.

- Temporarily reduce wants to 20% and savings to 15% while you work on lowering needs.

Scenario B: Your wants are 45% of income

- Identify your top 3-5 “want” categories that bring the most joy.

- Cut or reduce the rest. Cancel unused subscriptions, cook at home more often, find free entertainment.

Scenario C: You’re saving less than 10%

- Start small. Even bumping savings from 5% to 10% is progress.

- Automate transfers to savings the day you get paid so you “pay yourself first.”

- As you pay off debt, redirect those payments into savings to hit 20%.

For meal planning to reduce food costs, check out our meal prep guide—it’s a game-changer for cutting grocery bills and eating healthier.

Step 4: Automate Your Budget

The best budget is one you don’t have to think about every day. Set up automatic transfers and payments so your money flows where it needs to go without constant decisions.

Automation Checklist:

- Direct deposit splits (if your employer allows): 50% to checking for needs, 30% to secondary checking for wants, 20% to savings.

- Auto-transfer to high-yield savings account on payday.

- Auto-pay for fixed bills (mortgage, utilities, insurance).

- Automatic 401(k) or IRA contributions from your paycheck.

This removes willpower from the equation. You’re not tempted to spend money that’s already been moved to savings.

Step 5: Review and Adjust Monthly

Your budget isn’t set in stone. Life changes—income fluctuates, expenses pop up, priorities shift.

Monthly Review Questions:

- Did I stay within my 50/30/20 targets?

- What unexpected expenses came up, and how can I plan for them next month?

- Are there subscriptions or expenses I’m no longer using?

- Am I making progress on my savings and debt goals?

Set a recurring calendar reminder for the last Sunday of each month to review your budget. It takes 15-20 minutes and keeps you on track.

Related Articles:

Common Mistakes to Avoid

Mistake #1

Miscategorizing Needs and Wants

It’s easy to convince yourself that the premium cable package or daily takeout coffee is a “need.” Be brutally honest. If you could survive without it in an emergency, it’s a want.

Mistake #2

Ignoring Irregular Expenses

Car insurance paid twice a year, annual subscriptions, holiday gifts—these aren’t monthly, but they’re real expenses. Divide the annual cost by 12 and budget for them monthly so you’re not caught off guard.

Example: $600 car insurance every 6 months = $100/month you should set aside.

Mistake #3

Not Building an Emergency Fund First

Before aggressively paying off low-interest debt or investing, save at least $1,000-$2,000 for emergencies. Without this buffer, one unexpected expense sends you back into debt.

Mistake #4

Giving Up After One Bad Month

You’ll have months where you overspend or life throws a curveball. That’s normal. Don’t abandon the budget—just adjust and keep going. Progress, not perfection.

When the 50/30/20 Rule Doesn’t Fit

This framework is a guideline, not a law. There are situations where you’ll need to adapt:

High Cost of Living Areas

If you live in an expensive city, your needs might be 60-65% of income. That’s okay. Adjust to 60/25/15 temporarily and work toward the standard split as income grows or expenses decrease.

Aggressive Debt Payoff

If you’re focused on eliminating high-interest debt, consider a 50/20/30 split—flip wants and savings so you’re putting 30% toward debt while still enjoying some quality of life.

Low Income or Financial Crisis

If you’re barely covering needs, focus on survival first. Even saving 5% is a win. As income increases or expenses stabilize, gradually work toward 20% savings.

High Income

If your needs are only 30-40% of income, don’t inflate your lifestyle to fill the 50%. Keep needs low, enjoy reasonable wants, and supercharge savings to 30-40%. This is how wealth is built. Learn more about building wealth in your prime years in our guide on Creating Multiple Income Streams After 40.

Tracking Your Progress: Celebrate the Wins

Financial progress isn’t just about the numbers—it’s about the freedom and peace of mind you’re building.

Milestones to Celebrate:

- First $1,000 in emergency savings

- Paying off a credit card

- Hitting 3 months of expenses saved

- Maxing out your 401(k) or IRA contribution

- Going a full month within your budget targets

Track these wins in a journal or app. Seeing progress motivates you to keep going, especially when the journey feels long.

Full Focus Planner

Real-Life Example: The 50/30/20 Reset in Action

Meet James, 47, Warehouse Supervisor

- Income: $54,000/year ($4,500/month after taxes)

- Starting situation: $8,000 credit card debt, no emergency fund, living paycheck to paycheck

James’s 50/30/20 Budget:

- Needs (50% = $2,250): Rent $1,200, utilities $150, groceries $400, car payment $250, insurance $150, minimum debt payment $100

- Wants (30% = $1,350): Dining out $300, hobbies $200, streaming services $50, gym $40, misc $760

- Savings/Debt (20% = $900): Emergency fund $300, extra debt payment $600

6-Month Results:

- Built $1,800 emergency fund

- Paid off $3,600 in credit card debt

- Reduced financial stress significantly

- Still enjoyed life with intentional spending

James didn’t make drastic sacrifices—he just gave his money a clear job to do. You can read more about building financial confidence in our article on The Mid-Life Wealth Building Blueprint.

Tools and Resources to Support Your Budget Reset

Budgeting Apps:

- Mint (free): Tracks spending automatically, categorizes expenses

- YNAB (You Need A Budget): Proactive budgeting, great for goal-setting ($14.99/month)

- EveryDollar: Simple zero-based budgeting (free version available)

Financial Education:

- “The Total Money Makeover” by Dave Ramsey: Step-by-step debt elimination and wealth building

- “Your Money or Your Life” by Vicki Robin: Mindset shift around money and values

- “The Simple Path to Wealth” by JL Collins: Straightforward investing for beginners

Banking Tools:

- High-yield savings accounts: Ally Bank, Marcus by Goldman Sachs, Discover (4-5% interest vs. 0.01% at traditional banks)

- Automatic transfer apps: Digit, Qapital (automate small savings transfers)

For a deeper dive into building unshakeable financial confidence, check out our post on Building Unshakeable Confidence in Your 40s and Beyond.

Taking the First Step Today

You don’t need to overhaul your entire financial life overnight. Start with one action today:

Daily Action Steps:

- Day 1: Calculate your after-tax monthly income

- Day 2: Download a budgeting app or grab a notebook

- Day 3: Track every expense for the next 30 days

- Day 4: List all your monthly bills and categorize them (needs vs. wants)

- Day 5: Open a high-yield savings account

- Day 6: Set up one automatic transfer to savings ($25, $50, $100—whatever you can)

- Day 7: Review your subscriptions and cancel one you don’t use

Small, consistent actions compound into massive results. The 50/30/20 budget reset isn’t about perfection—it’s about progress, clarity, and taking control of your financial future.

“You must gain control over your money or the lack of it will forever control you.”

— Dave Ramsey

Your prime years are the perfect time to build the financial foundation that will carry you into retirement with confidence and freedom. You’ve got this.

For more strategies on optimizing your life after 40, explore The Triangle of Well-being to see how physical, mental, and financial health work together.

Ready to take control? Start your 50/30/20 budget reset today and build the financial future you deserve.

Disclosure

This article contains affiliate links. If you choose to make a purchase through these links, we may earn a commission at no additional cost to you.

Important Note: The information provided in this article is for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making significant financial decisions. Your situation is unique, and these general guidelines may need to be adjusted to your specific circumstances.